Tax on car sales in 2018

Good afternoon, dear reader.

Every car owner sooner or later has to face the need to sell his own car. The reasons for the sale can be completely different, but today we will not talk about them. I think it’s no secret to you that currently all transactions for the sale of property are subject to income tax. This also applies to transactions aimed at selling a car.

The amount of tax on car sales depends on several factors, which will be discussed in this article. In addition, we will talk about situations in which income tax on the sale of a car can be avoided for completely legal reasons.

Even if you are not planning to sell your car in the near future, I recommend that you read the text of this article. The information received will help you avoid unnecessary problems in the future.

For clarity, I propose to consider in this article several examples of car sales:

- The car was purchased in January 2017 for 500,000 rubles and sold in September 2017 for 450,000 rubles.

- The car was purchased in January 2013 for 300,000 rubles and sold in September 2017 for 450,000 rubles.

- The car was purchased in January 2017 for 200,000 rubles and sold in September 2017 for 450,000 rubles.

- The car was purchased in January 2017 for 500,000 rubles and sold in September 2017 for 600,000 rubles.

- The car was purchased in January 2017 for 200,000 rubles and sold in September 2017 for 250,000 rubles.

In the process of studying this article, you will learn how to determine the amount of tax on the sale of any car and will be able to easily calculate the amount of contributions to the state for Yenisei cars.

Amount of car sales tax

The personal income tax is currently 13 percent .

In relation to Yenisei brand cars, the amount of income tax is:

450,000 * 0.13 = 58,500 rubles.

Agree, the amount is quite impressive. However, none of the sellers will have to pay this entire amount.

Car sales tax

Let's consider the main situations in which the tax amount can be reduced:

1. Lack of income

Let's take a closer look at the situation with the car again. This car was bought for 500,000 rubles and sold for 450,000 rubles. Obviously, in this case the seller did not receive any income at all, i.e. the income tax amount is 0.

However, in this case, you should pay attention that in order to be exempt from paying tax on the sale of a car, you must submit a declaration to the tax office with attached sales agreements (or copies thereof). We will talk more about the deadlines for filing a declaration a little later.

In this case, there must be 2 contracts. One of them was drawn up when buying a car (in January), and the other when selling it (in September). If the car purchase and sale agreement has not been preserved, then you should turn to other ways to reduce the tax.

2. Long-term car ownership

Let's consider a car that was sold for 150,000 rubles more than it was purchased. This car will also not be subject to income tax, because... it was owned for more than 3 years. Tax Code of the Russian Federation, Article 217:

Thus, long-term ownership of the car can completely exempt the seller from paying tax.

3. Tax deduction

The owner of a car can count on receiving a tax deduction if he was unable to completely avoid paying taxes using one of the above methods.

This item includes cars that were sold for more than they were purchased and were owned for less than 3 years. In addition, the same point applies to the owner of a car who has lost the contract of sale of the car.

Article 220 of the Tax Code:

So, what does a tax deduction of 250,000 rubles mean? In this case, 250,000 rubles will be deducted from the cost of the car upon sale, and tax on the sale of the car will need to be paid from the remaining amount.

: (450,000 – 250,000) * 0.13 = 26,000 rubles.

: (450,000 – 250,000) * 0.13 = 26,000 rubles.

(250,000 – 250,000) * 0.13 = 0 rubles.

Please note that a car sold for 250,000 rubles or less is not subject to sales tax. However, keep in mind that a tax deduction in the amount of 250,000 rubles is provided only once a year .

For example, with the simultaneous sale of cars and the tax amount will be:

(450,000 + 250,000 – 250,000) * 0.13 = 58,500 rubles.

Taxes on the sale of 2 cars

4. Reducing income by the amount of expenses

There is another option for reducing the tax amount - reducing income by the amount of expenses. Article 220 of the Tax Code of the Russian Federation, part 2:

This option makes sense to use if the car is sold for more than it was purchased.

The method is well suited for selling a car (it was bought for 500,000 rubles and sold for 600,000 rubles).

In this case, the tax amount will be:

: (600,000 – 500,000) * 0.13 = 13,000 rubles.

If in the same situation you use a deduction of 250,000, then the tax amount will be significantly higher:

: (600,000 – 250,000) * 0.13 = 45,500 rubles.

However, there are times when you have to use the second option. For example, if the car purchase agreement is lost and it cannot be provided to the tax office.

Please note that you cannot take advantage of the 250,000 deduction at the same time (for the same car) and reduce income by the cost of expenses. You are only allowed to select one of the options.

So, once again I will give a list of situations in which tax on the sale of a car may not be paid:

- The cost of the car when selling is less than the cost when buying;

- Owning a car for 3 years or more;

- The car's selling price is 250,000 or less.

In all other cases, you will have to pay tax when selling a car. By the way, starting from 2011, the sale of a car can be carried out according to a simplified scheme, without deregistering the car.

Which tax reduction option should I choose?

The following table shows the best options for the most common situations:

| Situation | Method of reducing the tax base | Article paragraph |

| The car purchase agreement was lost | Tax deduction | Point 3 |

| The purchase agreement is in hand, the sale price is less than the purchase price. | Reducing income by expenses | Point 4 |

| The purchase agreement is in hand, the sale price is greater than the purchase price, the purchase price is less than 250,000 rubles. | Tax deduction | Point 3 |

| The purchase agreement is in hand, the sale price is greater than the purchase price, the purchase price is more than 250,000 rubles. | Reducing income by expenses | Point 4 |

Not in every situation the tax can be reduced to 0, but using the table above you can achieve the minimum payment amount.

Procedure for paying tax when selling a car

Please note that even if, according to your calculations, you do not owe anything to the tax authorities after selling the car, you will still have to file a declaration . The only condition under which you do not need to file a declaration in 2018 is that you have owned the car for more than 3 years.

The tax return for the current year (2018) is due at the beginning of the next year (2019). The deadline for the tax office to accept your return without penalties is April 30 . I recommend filing your declaration at the end of February or beginning of March, because... By the end of March, the season of queues begins at the tax office.

When selling a car, a tax return is filled out using a special program that can be downloaded from the tax office website. Let me emphasize that the program for 2018 will appear only at the beginning of 2019. It makes no sense to use last year's programs, because... Tax laws can change significantly over the course of a year.

Instructions for filling out the declaration

In addition to filing a tax return, the car seller must also pay income tax. This can be done either immediately after selling the car or after filing a tax return (but before July 15 ).

The payment of tax on the sale of a car by non-residents deserves special attention. First, let's figure out who is recognized as a tax resident of the Russian Federation (Article 207 of the Tax Code):

All other car sellers in the Russian Federation are not tax residents.

If you are not a tax resident of the Russian Federation, then keep in mind that you will have to pay tax on the sale of a car in any case. And its value will be 30 percent of the sale price.

So, let's summarize this article :

I am sure that after reading this article, calculating tax on the sale of any car will not be difficult.

Source: https://pddmaster.ru/interest/nalog-s-prodazhi-avtomobilya-v-kakom-sluchae-ne-nuzhno-platit-podoxodnyj-nalog.html

Tax on car sales in 2018 – All about finance

The relationship between the seller and the buyer in Russia entails benefits for both parties, but the state must also have something from it. As you might guess, the article will discuss when and how much to pay tax on the sale of a car. We will also answer other questions related to the topic and provide calculation examples.

When is a transaction subject to tax?

Two taxpayer entities agree to conduct a transaction on a private level, without a fiscal receipt. The property is a vehicle, the price of which exceeds 250 thousand in national currency. If so, then we are talking about the need to draw up a declaration, as required by compliance with Article 220 of the Tax Code of the Russian Federation and payment of income tax of 13%.

Take into account! Tax is imposed not only on objects of sale and purchase, but also on cars received as a gift or inheritance, or cars won in a lottery.

It doesn’t matter how the car came into your possession, it is important to have at your disposal all the documents confirming this. As well as the result of the estimated value of the car, on the basis of which the tax rate is calculated.

When can you sell a car without paying tax?

Before the transaction, it is worth checking whether the object of sale falls under tax conditions. The seller must take care of this, in whose interests it is to sell the goods legally and quickly. The seller should also check the need to prepare a 3-NDFL declaration, since he receives income.

Owners of a car who resell it after owning it for less than 3 years are required to fill out the form completely.

Even if the car was taken on credit, its value is subject to tax.

So when is tax not paid on the sale of a car?

Here are all the conditions:

- If the car was purchased more than three years ago (for transactions carried out in 2018 - if the car was purchased by the first owner in 2015 or earlier);

- If the profit from the transaction is negative, that is, the car is sold at a price lower than the one for which it was bought;

- If the sales price of the car is less than 250,000 rubles.

- The conditions are mutually offset, that is, it is enough to fulfill at least one of them for the former owner to receive a tax benefit.

As noted, tax is paid if the cost of the car exceeds 250 thousand rubles. All cars sold at a lower price automatically “give” their seller a 0% tax rate.

There are two methods of calculating tax on car sales:

- Cost-based method - implies that the owner has papers indicating the price and other costs of the purchase. Then the sale amount is deducted from the original price. The difference is the basis that is subject to income tax of 13%.

- Subtraction method. If documents from the original purchase are lost, then it is difficult for the owner to prove what the old price was. It’s easier to do this: subtract 250,000 from the new sale price and get the difference. If it is negative, then the transaction is not subject to tax. The positive basis must be multiplied by 0.13 and the resulting amount, rounded to hundredths, must be paid to the treasury.

Example 1. Cost-based method of calculation

A car was purchased in 2017 for 500 thousand rubles. In 2018 they decide to sell it for 550 thousand. The difference in cost is 50,000 rubles, it needs to be multiplied by 0.13, we get 6,500. This amount will have to be paid from the transaction as income tax.

Example 2. Subtraction method

New amount 550,000 – 250,000 = 300,000. We multiply this amount by 0.13 and get 39,000 tax.

We see that this method is not as profitable as the first. What is the problem, why can’t you always use a more profitable and costly method? The fact is that the state allocates one opportunity for its use per year per seller. That is, if you sell several cars for profit, you will have to use the “subtraction” method.

Are you having legal problems?

Need advice from a professional lawyer?

* – Call cost according to your operator’s tariffs

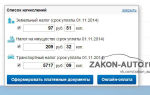

Table “Examples of calculating tax on car sales”

| Situation | Tax calculation |

| The cost of the car is less than 250 thousand rubles. For example, 200 thousand | 0.13*(200,000 – 250,000) = Negative amount, no need to pay |

| The cost of the car is 300 thousand, you are selling a car that has been owned for 2 years. | 0.13*(300,000 – 250,000) = 6,500 rub. |

| The cost of the car is 300 thousand. Have you already used a tax deduction this year for a similar transaction? | 0.13*300,000 = 39,000 rub. |

| The cost of the car is 400 thousand, but the original cost was 350 thousand, which is confirmed by documents. | (350,000 – 400,000)*0.13 = Negative amount, no need to pay |

When and how to fill out a declaration

An individual must independently report all income for the year to the Federal Tax Service. This is done in the next reporting year, no later than April 30. At the same time, even more time is given to pay the tax, until July 15.

Source: https://vseofinansah.ru/nalogi/nalog-s-prodazhi-avtomobilya

Car sales tax. How much personal income tax will you have to pay? And In what case do you not need to pay income tax? — DRIVE2

fingers…

Every car owner is faced with the situation of having to sell an old car and purchase a new one. There are many reasons why a car owner decided to part with his old car, but we will not dwell on them in detail. Not everyone knows that some property sales are subject to tax, this also applies to the sale of a car.

The amount of tax on car sales depends on various factors, which will be discussed in this article. We will also consider the situation when you do not have to pay income tax on the sale of a car.

In what cases will it be possible to avoid the tax burden when selling a car?

Income tax, also known as personal income tax, is currently 13%. Let's look at several situations where you won't have to pay personal income tax after selling a car.

1. Long-term car ownership. Art. 217 of the Tax Code of the Russian Federation indicates income that is not subject to taxation. Let us turn to clause 17.1 of Art.

217, which states that income received by individuals who are residents of the Russian Federation from the sale of residential houses, apartments, land plots, garden houses, dachas owned by the taxpayer for more than three years, as well as from the sale of other property owned by the taxpayer for three years or more are not subject to taxation.

From this we conclude that if you have owned a car for more than three years and decided to part with it, no income tax will be paid on the transaction. In addition, this is the only case in which there is no obligation to file a tax return.

2. Lack of income. If a citizen purchased a car for 500 thousand rubles and sells it for 450 thousand rubles, in this case there is also no need to pay tax on the sale of the car. This rule follows from the fact that the car owner did not receive any profit from this transaction. True, in this case you will have to submit a tax return and documents confirming the purchase and sale of the car.

What to do if the necessary documents are lost or the car is sold for a larger amount than it was purchased.

Tax deduction - a way out of the situation

A citizen has the right to receive a tax deduction if he was unable to avoid taxation under one of the above options. Art. 220 of the Tax Code indicates that there is the possibility of a tax deduction from the sale of other property that is not real estate.

If you sell a car that you have owned for less than three years, then you have the right to receive a tax deduction in the amount of 250 thousand rubles.

For example, a citizen sold a car that he owned for less than three years for 600 thousand rubles, in this case the personal income tax will be 600 * 0.13 = 78 thousand rubles, if we apply a tax deduction, we will get (600-250) * 0.13 = 45.5 t.r. We can conclude that by selling a car using a tax deduction, you can save a considerable amount of money.

But, it must be remembered that a citizen must independently apply to the tax authority for a tax deduction, since the tax office is not obliged to provide tax deductions itself. The specified tax deduction is provided for a total amount of not 250 tr. per calendar year, even if you sell several cars.

A legitimate question arises: “what if the contract specifies an amount of no more than 250 tr, even if the vehicle is actually sold at a higher price?”

Let's look at a few examples of calculating tax on car sales:

You purchased a car in 2014 for 300 thousand rubles and are going to sell it in 2015 for 350 thousand rubles. The tax base in this case is equal to 100 thousand rubles (350-250). Income tax in the example considered will be 100 * 0.13 = 13 thousand rubles.

You purchased a car in 2014 for 230 thousand rubles and are going to sell it for 240 thousand rubles. The tax base in this case will be zero (240-250).

This example shows that if the amount of income from the sale of a car is less than 250 thousand rubles, then there is no need to pay tax on the sale of the car.

You bought a car for 600 thousand rubles, and a year later you sell it for 500 thousand rubles. In this case, several options are possible:

1) You will not pay personal income tax when selling a car if you provide the tax office with documents confirming the amount of costs. To do this, you must submit an application along with the declaration and provide documents confirming the costs of purchasing the car.

These documents include: civil contracts (purchase and sale and others), a purchase and sale agreement must be present, since it allows you to establish the rights and obligations of the parties, the affiliation of payment documents to the transaction, its amount, etc.

; payment documents (cash and sales receipts, cash receipt orders, receipts, payment orders, bank statements, etc.)

2) You will pay tax if you cannot provide documentary evidence of the purchase costs incurred. If we apply a tax deduction to the situation under consideration, then the taxable base will be 250 thousand rubles. The amount of tax on the sale of a car in this case will be 250 * 0.13 = 32.5 thousand rubles.

You bought a car in January 2009 for 600 thousand rubles and sold it in April 2015 for 650 thousand rubles. In this situation, you do not need to pay any income tax to the tax office, since you have owned the car for more than three years and are exempt from taxation.

Based on the examples discussed, you can now independently calculate the amount of tax on the sale of a car if you encounter such a situation.

Useful tips for minimizing the amount of tax when selling a car

Be sure to keep your car purchase documents, as you may need them in the future if you decide to sell the car and avoid taxes.

If the seller is an individual, do not forget to take a receipt from him indicating that he has received the money.

The receipt must indicate the surname, first name, patronymic of the seller, passport details, the amount received by him and an indication of under which agreement (date, number) these funds were received.

If your thoughts are pure and you are sure that the buyer will not have problems registering the car, try to negotiate with him to indicate a reduced transaction amount, within the amount of the tax deduction. This will help you completely avoid tax on car sales.

If you are going to sell a car, and you have owned it for about three years, wait until you have owned it for three years. This will help you avoid many problems, such as paying taxes and filing a tax return with the tax office.

Source: https://www.drive2.ru/b/2550299/

How to legally avoid paying tax on car sales?

The sale of a car (hereinafter referred to as a/m), like any other property, implies the receipt of income, which, in turn, gives rise to the obligation to pay tax on this profit. The article will discuss all legal ways of exemption from payment of payments on the sale of vehicles.

Before moving directly to the methods of exemption from personal income tax, we will consider in which cases the obligation to calculate tax arises and in which not, how to correctly calculate personal income tax and declare the income received.

When do you need to pay personal income tax on income from the sale of a car?

The obligation to calculate and pay this payment to the budget arises if the sold vehicle was owned for less than three years. Otherwise, no tax is payable.

How to calculate tenure?

- Months, not years of ownership, are taken into account;

In order to receive tax exemption, the car must be owned for at least 36 months.

This is important because the tax authorities calculate the time of ownership based on the number of months during which the property was owned, and not on the total number of years.

In this case, a full or incomplete month does not matter.

Example #1

Sukhanov V.A. I purchased the car in March 2013 and sold it in February 2016. The tenure period is 35 months. Thus, Sukhanov must pay tax on the income from the sale, but if the car was sold a month later, he would not have to pay personal income tax.

Example No. 2

Sukhanov V.A. purchased the car on December 30, 2013, and sold it on December 29, 2013. Formally, the car was owned for less than 3 years, but since the total number of months is 36, personal income tax is not subject to payment to the budget.

- The period begins to run from the date of conclusion of the vehicle purchase and sale agreement, or from the date specified in the invoice certificate.

This is important, since many people mistakenly believe that the period of ownership of a vehicle begins to be calculated from the date of registration, which leads to additional tax on the sale of the car if the three-year period is not met.

How to calculate personal income tax on the sale of a car

The tax payable to the budget is calculated using the following formula:

(Income from car sales – n/v) x 13%

In this case, deduction (n/a) means the ability to reduce the income received from the sale of a vehicle by:

- The amount of costs for purchasing a car

on either

A citizen can apply a deduction in the amount of expenses if these expenses are supported by documents.

If a citizen cannot confirm the purchase expenses (receipts are missing or lost) or they were not there (the property was received as a gift or inheritance), then he can take advantage of a benefit in the form of a deduction in the amount of 250,000 rubles.

Example No. 3

Sukhanov V.A. in 2015 I bought a car for 900,000 rubles, and in 2016 I sold it for 750,000 rubles. Since the period of ownership of the car is less than 36 months, he is obliged to pay personal income tax to the budget.

Due to the fact that Sukhanov has documents confirming the costs of purchasing the car, he can reduce the income received by the amount of these costs.

Thus, the personal income tax payable will be equal to :

(750,000 – 900,000) x 13%

Let’s say Sukhanov received the car as a gift, then he can only use it in the amount of 250,000 rubles. and the tax payable will be 65,000 rubles:

(750,000 -250,000) x 13%

It is worth noting that if Sukhanov sold 2 cars at the same time, then a deduction of 250,000 rubles. he could use only one car at a time.

Having decided what tax is paid on the sale of a car, we will outline the main legal ways to avoid paying personal income tax.

How to avoid paying tax on car sales

- Vehicle ownership period – more than 36 months;

- Income from the sale of a vehicle is less than the costs of its purchase (subject to supporting documents);

- Income from the sale of a car is less than RUB 250,000. (tax deduction amounts).

Our lawyers know the answer to your question

If you want to find out how to solve your particular problem , then ask our duty lawyer online. It's fast, convenient and free !

or by phone:

- Moscow and region: +7-499-938-54-25

- St. Petersburg and region: +7-812-467-37-54

- Federal: +7-800-350-84-02

Procedure for selling a car

- Determination of vehicle ownership period;

If more than 36 months, no further action needs to be taken.

If the cost of the car is less than 250,000 rubles. or less than the cost of its purchase (if there are documents confirming the purchase) - you do not need to pay tax.

It is necessary to fill out and submit reports in Form 3-NDFL even if the tax payable is 0. Only those who have owned a car for more than 36 months do not submit a declaration.

The deadline for submitting reports is April 30. Late submission of reports may result in tax liability and a fine.

If the deadline falls on a weekend, it is moved to the next working day.

You can submit your declaration in person, through a representative, by mail, or online.

The declaration is submitted to the inspectorate at the place of registration of the citizen.

The payment deadline is July 15th of the year following the income received. If in 2016, then the tax must be paid by July 15, 2017.

Also, as in the case of the declaration, if the deadline falls on a weekend or holiday, it is postponed to the first working day.

Source: http://law03.ru/finance/article/nalog-s-prodazhi-avtomobilya

What is the tax on car sales

Any car owner at some point decides to sell his car. This raises the question of whether it is necessary to pay tax on the sale of a car. As a general rule, property transactions are subject to income tax. The law establishes under what conditions and in what order tax is paid on transport transactions.

Selling a car provides the former owner with a financial benefit, which may be taxable income. The rate and procedure for calculating the tax depend on the status of the vehicle owner.

Article 224 of the Tax Code of the Russian Federation reflects the size of the fixed income tax rate for citizens (NDFL) - 13%. By selling a vehicle, an individual receives income equal to the cost of the car. The price is confirmed by the vehicle purchase and sale agreement.

A tax rate of 13% is established for residents. These mainly include citizens permanently residing in Russia. When selling a car, personal income tax is charged to non-residents in the amount of 30% of the contract price of the vehicle.

Calculation, payment and submission of documents to the tax office rests entirely with the seller of the car. The amount paid is reduced by applying deductions and expenses when purchasing a car.

Such expenses must be documented.

The sale of transport by a legal entity is regarded as the disposal of one of the fixed assets. Such income is taken into account when calculating income tax. In this case, the amount of financial benefit is reduced as follows:

- the contract price is reduced by the residual value of the car;

- the amount of expenses incurred in connection with the sale is deducted - costs of storage, maintenance, evaluation, transportation, etc.

If expenses exceed actual income, the loss is included in the volume of other expenses in equal shares in subsequent periods. This procedure is applied by organizations that are on the general tax payment system. Additionally, VAT is calculated and paid on sales of cars by companies.

When tax is not paid

Selling a car does not always entail mandatory payment of personal income tax. In three cases, the seller is exempt from tax liability and the need to submit a tax return:

- Long period of car ownership. The payment is not made to the budget if the car is owned by the resident for more than three years. To calculate the period, you should focus on the date of registration of the vehicle with the traffic police, from which 36 months must expire. It is important that at this time the car is listed only as your property. If the period is interrupted, it is calculated anew with each new registration.

- No profit from the transaction. There is no need to pay 13% of the cost if the sale price is lower than the purchase price. In this case, the owner did not receive any income from the sale of the vehicle. It is necessary to submit a declaration and supporting documents. These are usually purchase and sale agreements. If they are lost, you can provide written evidence of the transfer of money to the previous owner, including payment documents and receipts.

- Use of tax deduction. Currently, the property deduction is 250 thousand rubles. The tax base (the cost of the car under the contract) is reduced by this amount, which is then multiplied by 13%. If the contract price of the car is 250 thousand rubles. or lower, then the amount of tax to the budget will be zero. Often the price in the documents is understated on purpose in order to avoid paying tax. The inspection is not able to verify the reality of the price indicated in the transaction and the actual amount transferred from the buyer to the seller.

Filing a declaration

When considering the question of whether you need to pay tax on the sale of a car, do not forget about the obligation to submit a declaration to the inspectorate in the prescribed form 3-NDFL. The declaration must be prepared in writing or electronically and submitted in the following ways:

- Filled out in person at the tax authority on a special form. Afterwards it is handed over to the office. Submission by notarized power of attorney is permitted.

- Sent by mail in a valuable letter with a mandatory list of attachments.

- Submission via website. The document is generated on a computer and in electronic form and sent to the Federal Tax Service of your city.

If you cannot fill out the declaration yourself, you should contact the appropriate accounting firm. Such organizations provide services for providing documents to government agencies. You can also use a special program posted on the Federal Tax Service website. It can be downloaded to your computer for free.

In the window that opens, fill in the data from your documents. Then a declaration is automatically generated with all the details, calculation of the size of the tax base and tax. The application interface and data instructions are quite clear and simple for the user.

Deadlines for submitting the declaration

Submission of documents and payment of tax are carried out the next year after the sale of the car. The law sets the deadline for submission until April 30. If the obligation to pay personal income tax arises, the funds are transferred to the budget before July 15.

Late payment will result in a penalty. The declaration is verified within three months. If errors or violations are identified, explanations are sent to the place of registration with a request to eliminate them.

In case of overpayment of personal income tax, the refund is made within 30 days.

If you do not know in what case you need to pay tax on the sale of a car, you should wait for a letter from the Federal Tax Service. The government agency sends notices of the need to submit a declaration and make payments to all obligated persons before the due date.

If a debt arises, you will receive a request from the inspectorate asking you to pay the debt. It will contain the calculation of amounts indicating the periods of their formation. If the budget does not receive payment within the prescribed period, the government agency will go to court. In such cases, a court order is issued, which is handed over to bailiffs for execution.

Deduction from the sale of a car

Tax deduction in the amount of 250 thousand rubles. applies to the sale of vehicles whose ownership period is less than 3 years. Unlike real estate, you won't be able to take the deduction if you buy a car on credit. You can obtain the right to a deduction under the following conditions:

- the individual is a resident of the Russian Federation;

- copies of transport documents were provided;

- proof of income has been provided.

The deduction can be applied an unlimited number of times, but only in different tax periods. Its registration is permissible only in the period when the car was sold. If the deadline is missed, it is impossible to restore it or apply the benefit retroactively.

Documents confirming the right to deduction:

- declaration 3-NDFL;

- passport of sold transport;

- document confirming the purchase of the car;

- evidence of the price paid when purchasing the vehicle (cash receipts, transfers, receipts). If there are none, the government agency will accept the cost of selling the vehicle as the seller’s net profit;

- purchase and sale agreement confirming the fact of sale of the vehicle in a specific tax period;

- document confirming receipt of funds from the sale.

If documents on purchase costs have been lost, they can be restored by the traffic police. When a declaration is submitted without supporting evidence, a letter may be sent from the inspectorate requesting documents.

Transport tax when selling a car

Transport tax is calculated as the product of vehicle capacity and the established rate. Rates may vary depending on the region, as they are adjusted by local government agencies.

Enterprises calculate the amount themselves, pay advances and submit declarations every year. For citizens, the calculation is made by the inspectorate based on data received from the traffic police.

Individuals will learn about payment deadlines, payment amounts and settlements from a written notice.

The general rule for all categories of taxpayers is the obligation to pay only for the actual period of ownership of the car. This means that the tax must be paid for the period from the beginning of the year until the car is deregistered. The ratio of the number of complete months of car ownership to the number of months in a year is applied.

The former owner must receive the last notice of the sold car the following year after the transfer of ownership. The inspection must calculate the amount, inclusive of the month the vehicle was deregistered. But sometimes letters continue to arrive in subsequent years.

The reasons may be the lack of up-to-date information from the traffic police, or an error by the tax authorities. It is not difficult to eliminate such inconveniences; it is enough to provide the relevant data to the government agency. The situation is more complicated when the new owner did not deregister and register the vehicle in his name.

This point must be checked when carrying out a purchase and sale transaction.

Source: http://znatokdeneg.ru/dengi-i-gosudarstvo/nalogi/kakoj-nalog-s-prodazhi-avtomobilya.html

Car sales tax in 2018: how and how much to pay

Selling a vehicle is a profitable procedure, as a result of which the owner receives taxable income. When deciding to sell a car, each car owner, in addition to assessing his “iron horse” and the expected profit for it, must be prepared to pay a duty to the state in the amount prescribed by law.

The amount of tax on the sale of a car is not a fixed amount and depends on a number of factors.

There are cases that the purchase and sale of a vehicle costs the seller without paying personal income tax.

The mechanism of taxation and exemption from it for the purchase and sale of cars in 2018 is regulated by Chapter 23, Article 217, Article 224, Article 229 of the Tax Code of the Russian Federation.

Selling a car in 2018: tax amount

As established by current legislation, namely Article 224 of the Tax Code, the tax rate is set at 13 percent of citizens’ income. The amount of income from the sale of a car is its cost, fixed by the counterparties of the purchase and sale agreement.

This rate - 13% - is established only for tax residents of the Russian Federation; for non-residents, the above-mentioned article sets the amount of income tax at 30%.

Is it always necessary to pay tax on car sales?

Many potential car sellers are hesitant about whether to sell the car or continue to drive it until final depreciation separates them, fearing that they will have to pay income taxes. But Art. 217 of the Tax Code prescribes cases when the seller of property may be exempt from the mandatory payment of state duty.

If a car owner is not a fan of frequently changing cars and owned his car for more than three years before deciding to sell it, then after selling such property he will not have to pay any taxes. Therefore, if the life of the car is approaching the borderline tax-free three years of operation, it makes sense for the owner to wait for the expiration of the period established by the Code.

It is reasonable to fail to pay tax on an individual’s income if no profit arose during the transaction. This refers to a situation where the cost of purchasing a car exceeds the amount received from selling it.

But this does not exempt you from filing with the tax authorities, and in personal income tax-3 you will have to present all the data about the lack of profit during the transaction and support it with documents confirming this.

Filing a tax return

Having received any income, any law-abiding citizen must declare it to the tax authorities. After the reporting period - in this case, a calendar year - you need to submit a completed declaration of standard form 3-NDFL to the tax police at your place of residence.

Since 2015, namely in February, a new declaration form has been put into effect, approved by Order No. ММВ-7-11/671 of December 24, 2014 of the Federal Tax Service.

This must be done before April 30 of the year following the reporting year in which the income was received, for example, from the sale of a car.

Today, it is common practice to electronically fill out and submit tax returns on the official website of the Federal Tax Service https://lk2.service.nalog.

ru/lk/ with the submission of electronic copies of all necessary documents, sealed with an electronic signature.

This progressive type of reporting makes the process absolutely “painless” and quick, especially since the official recommendations on the website clearly indicate how to fill out the declaration correctly.

If the declaration is submitted in paper form, then there are a number of recommendations for its external and internal design:

- all sheets of the declaration (including the title) must be affixed with a personal signature;

- It is recommended to fasten pages with paper clips (not a stapler);

- indicate amounts in rubles without kopecks;

- indicate personal data legibly, preferably in block letters.

Find out what the tax on car sales is in 2018 from the video.

How to get out of this situation - tax deduction

The Tax Code is not as scary as it is made out to be. It’s just that few participants in purchase and sale transactions know about their rights under the law, and tax officials are in no hurry to tell them how to save on their hard-earned payments when selling their own car.

But the state has provided a kind of “discount” when paying tax on the sale of a car and Art.

220 of the Tax Code of the Russian Federation, states that if both real estate and property of any other kind (including cars) that have been owned for three years or less are subject to sale, and a profit was made from its sale, the owner can claim a tax deduction .

The maximum amount is 250 thousand rubles.

Those hoping to receive a tax deduction should remember that:

- when filing a tax return, it is necessary to notify the tax authority about the claim for a deduction, because, as mentioned above, the service is not authorized to inform the population about this;

- the amount of 250,000 rubles from the cost of the car for calculating personal income tax is a one-time one and is provided as a tax “discount” once a year, even if an individual sells several cars, it is not provided for each car separately.

An example of calculating a tax deduction when selling a car:

Estimated cost of the car, thousand rubles, personal income tax,thousand rubles

Personal income tax using tax deduction, thousand rubles Saved funds, thousand rubles

| 750 | 750 x 13% = 97.5 | (750 – 250) x 13% = 65 | 97,5 – 65 = 32,5 |

Tax-free amount from car sales

It turns out that if the car was in operation for less than three years, and its cost is less than or equal to the amount of the tax deduction - 250 thousand rubles, then the profit from its sale is not subject to taxation. After all, if you subtract 250,000 rubles provided by law from the amount received for the sale of a vehicle, then there will simply be nothing to tax.

Therefore, when selling cars on the secondary market, sellers often ask when concluding a purchase and sale agreement to indicate in the contract a price not exceeding 250,000 rubles instead of the actual price. This is explained by reluctance to pay income tax.

Basically, this practice is common among car enthusiasts, as a kind of solidarity, because today's car buyer may also be in the buyer's place tomorrow.

Selling a car – both a passenger car and a truck, if it belongs to a legal entity – is not an easy task.

Enterprises of all forms of ownership, as participants in the general taxation system, have fixed assets on their balance sheet, which are vehicles.

By selling a fixed asset, the company receives income, but when calculating the amount of this profit, you need to take into account:

- value added tax;

- depreciation;

- disposal of fixed assets to the side.

In order to reduce the base subject to taxation, two methods can be used:

- as the service life of the machine increases, the residual value of the machine decreases;

- maintenance, appraisal, transportation and other pre-sale expenses.

The accounting department of an enterprise must record an expense as a separate expense item if the sale of the car was made at a loss to the company.

Penalties for tax evasion

If for any reason: intentional evasion of tax, ignorance of the need to file a declaration and subsequent payment of tax and other reasons, an individual does not provide this document within the period established by the Tax Code - after the first four months of the year following that , in which the transaction was made, such a defaulter faces liability in the form of fines, and sometimes quite significant:

- For each month overdue, the fine will be 5% of the amount that should have been paid as personal income tax.

- After six months of non-payment, if the persistent defaulter does not come to his senses, a fine of 30% of its amount will be added to the total tax amount.

How are these fines collected? At first, tax officials send official registered letters with acknowledgment of receipt, offering to repay the arrears of tax and “accumulated” penalties.

Then the case is sent to court and, with the help of the bailiff service, the debt is collected forcibly.

Citizens who have arrears in payment, including taxes and fees, are prohibited from traveling abroad.

Recommendations before selling a car

Experts recommend that citizens who legally decide to sell their car use the following qualified advice:

- for any purchase and sale transaction of a vehicle, it is necessary to retain all originals of notarized purchase and sale agreements, receipts for the transfer of funds and other documents accompanying the process of buying and selling a car to further confirm the possible non-receipt of profit and the absence of the need to pay tax;

- if there is no immediate need to sell the car, you need to wait until the three years after purchasing it. This will not only save you from paying tax, but also from preparing and submitting a tax return to the tax service;

- When selling a car, you should not neglect the taxation procedure and you need to take into account all the nuances provided for by current legislation.

You can learn how to pay tax on the sale of a car from the video.

Source: http://vesbiz.ru/likbez/nalog-s-prodazhi-avtomobilya.html