Registration of an MTPL policy via the Internet - DRIVE2

Greetings to everyone! I decided to tell you how to apply for an MTPL policy via the Internet. There is no need to stand in queues and get some other “add-on” added to the load. It so happened that in a month the MTPL policy for my car expires. I remember how a year ago I stood in line for almost 3 hours to get the “cherished” policy, and even with an additional bonus of 1000 rubles.

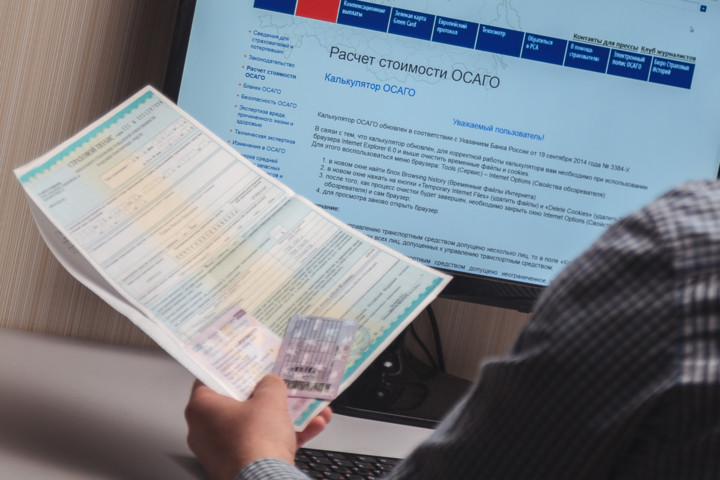

Well, I think no, I don’t want to repeat the mistakes. Moreover, our “dear” government has made concessions in obtaining this very policy via the Internet. This is how it happens. Using the example of the insurance company where I insure my car. I think the name is not necessary, fortunately there are no advertisements. So we go to the insurance company’s website. Select the “Apply for MTPL policy online” tab.

To issue an electronic MTPL policy, you must register in your personal account. Let's do this. Indicate your personal data: 1. Last name, first name, patronymic and gender.2. Mobile phone number, date of birth, series and number of the passport of a citizen of the Russian Federation.3. Registration address. All. registration is completed. We enter your personal account.

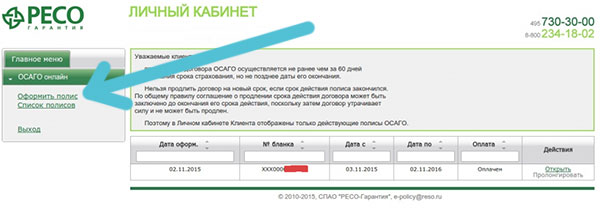

It contains information about current MTPL policies (if the policyholder-client has already insured a car with this company; if he has not, then such information will not be available :) : 1. Date of issue of the policy.2. Series and number of the policy form.3. Policy commencement date.4. Expiration date of the insurance period.5. Payment status.6. Actions with the policy.

You can view the policy data by clicking on “Open” or “Renew” a specific insurance contract. Attention! The prolongation of the MTPL contract is carried out no earlier than 60 days before the end of the insurance period, but no later than its expiration date. If you already have a policy and you want to renew it (extend for another same period), then simply click Renew.

The date of the new term in this policy will be entered automatically. Next, enter information about the diagnostic card (technical inspection). We add or remove drivers allowed to drive vehicles. The KBM code will be calculated automatically. Click calculate. If you are a new client of the company. Then you will have to fill out all the points of the policy. And this is: 1. Term of insurance;2. Information about the policyholder;3.

Information about the owner of the vehicle;4. Vehicle, make, model, number of l/s, VIN number, state sign;5. Vehicle passport;6. Number, date of issue and expiration of the diagnostic card;7. Persons allowed to drive a vehicle - driver’s full name, driver’s date of birth, date of issue of the first driver’s license, driver’s license series, driver’s license number, driver’s gender.

After entering data about the drivers, click “Calculate”. After clicking the “Calculate” button, the insurance premium under the contract is calculated. At the same moment, data on the driver’s/owner’s KBM is received from the AIS RSA. After reviewing and agreeing with the cost of the future policy, click “Save.” By clicking the “Save” button, you confirm your intention to conclude an agreement.

After clicking on the “Save” button, a window appears with the data on your policy - read it carefully and, if there are no inaccuracies, click “Save”. After successfully saving the policy, the “Pay” button becomes active. When you click it, you go to the payment system page. Select the type of your card (VISA, MASTERCARD) and click pay.

A window pops up in which you need to enter information about: 1. Enter the card number with which payment will be made.2. Specify the validity period of the card.3. Enter the cardholder (as indicated on the card).4. Enter the CVV2 code (located on the back of the card).5. Click to pay.6. Click if you refuse to pay.

After successful payment, you should return to the Personal Account page and refresh the page (F5), a link to download the policy should appear on the page, and an SMS and e-mail are sent to the client indicating the policy form number. Termination and changes to the electronic policy are carried out by submitting a written applications to the insurance company office.

The electronic policy is available for viewing and downloading in your Personal Account. We recommend that you print it out on the day of payment. The link to download the policy will become available after successful payment; to do this, you should refresh the page (F5). The PDF file is downloaded to the device using standard means and can

be printed from any compatible program, such as Adobe Reader.

Well, something like this :) I wrote longer than I took out a new policy.

Everything took about 10 minutes. In order to confirm to the traffic police officer that you have an electronic policy, you just need to print it out and take it with you. Let the employee check it against the database.

Oh yes, I completely forgot.

You might be wondering how much I had to pay. Since my wife was also included in the policy, and her discount was 40% (for me it was 45%), the insurance amount was calculated based on her. And it amounted to 7511.23 rubles for the year. Next is the calculation from the insurance company with coefficients. But it’s not very clear there.

Algorithm for calculating the insurance premium for the MTPL risk: TB - Base rate 4118.0KT - Territorial coefficient 1.9 - Kemerovo region, KemerovoKBM - Class coefficient (bonus-malus) 0.6KVS - Coefficient based on age and experience 1.0KO - Coefficient for limiting those admitted to management 1.0 KM - Power coefficient 1.6KS - Period of use coefficient 1.

0КП — Coefficient of the insurance period 1.0КН — Insurance tariff coefficient 1.0

Good luck to everyone on the roads!

Source: https://www.drive2.ru/b/2859491/

How to apply for an MTPL policy online?

From January 1, 2017, all insurance companies that have a license to conclude MTPL agreements are required to conclude MTPL agreements electronically throughout Russia.

The corresponding changes to the law on compulsory motor liability insurance were adopted at the initiative of the Bank of Russia.

The implementation of this measure allows citizens to save time in queues, avoid the unjustified refusal of insurance companies to conclude a compulsory motor liability insurance contract and impose additional services.

How to get an electronic MTPL policy?

The procedure is quite simple. You can buy a policy on the insurance company’s website on the Internet without leaving your home. In this case, access to the website of the insurance organization can be carried out through the website of the Russian Union of Auto Insurers (RUA). Any other methods of purchasing an electronic policy - through agents and other intermediaries - are illegal.

On the insurance company’s website, the car owner needs to fill out a form, register in his personal account, receive a login and password to access his personal account. Identifiers are transmitted to the car owner by email, SMS message, or by personally contacting the insurance company office.

After registration, an electronic signature key will be sent to the e-mail and (or) telephone number specified during registration, with which you can access your personal account on the insurance company’s website.

Next, you need to fill out an electronic application for registration of compulsory motor liability insurance in your personal account on the company’s website. To do this, you will need the data of the following documents: passport, driver’s license, vehicle registration document, diagnostic card. It is necessary to check that the application is filled out correctly before sending it to the insurance company’s website.

After receiving the information provided by the policyholder, the insurer will check it for compliance with the data contained in the automated compulsory insurance information system.

The response based on the results of the check will be sent to the policyholder’s personal account on the website of the selected insurance company. If the information is filled out correctly, a confirmation will be sent to the policyholder.

If there are errors, the policyholder will be sent a refusal with recommendations for correction.

Within 20 minutes after confirmation, the policyholder’s personal account will receive a calculation of the insurance premium. Next, you need to pay the insurance premium using a bank card or other available method on the insurance company’s website.

After payment, an electronic copy of the MTPL policy and a copy of the application for concluding the MTPL agreement will be sent to the policyholder’s personal account and email address.

The car owner, if desired, can also obtain a compulsory motor liability insurance policy on a strict reporting form, and he will need to personally contact the insurer’s division that provides this type of insurance.

A paper policy on the usual strict reporting form and a policy in electronic form are absolutely equivalent from the point of view of the law.

Free legal aid hotline

✆ 8(499)703-34-18 Moscow and Moscow region

✆ 8(812)309-84-53 St. Petersburg and Leningrad region

Source: https://DoorinWorld.ru/zakonodatelstvo/kak-oformit-polis-osago-cherez-internet

How to buy an MTPL policy online via the Internet. Step-by-step instructions for applying for a policy and renewing it

Despite the obvious advantages of purchasing insurance online, many car owners are afraid to use such a service. In this article we will describe in detail what the algorithm of actions is for obtaining compulsory motor liability insurance, what documents you need to have and other features of this procedure.

○ MTPL innovations

On July 1, 2015, changes to the Federal Law “On Compulsory Insurance...” dated April 25, 2002 No. 40-FZ came into force, which provide for the possibility of obtaining and renewing compulsory motor liability insurance via the Internet.

- “A compulsory insurance contract can be drawn up in the form of an electronic document, taking into account the features established by this Federal Law. The creation and submission by the policyholder to the insurer of an application for concluding a compulsory insurance contract in the form of an electronic document is carried out using the official website of the insurer on the Internet information and telecommunications network.” (clause 7.2 of article 15 No. 40-FZ).

Electronic insurance, which is issued in this way, is called e-OSAGO.

Return to contents ↑

○ Advantages and disadvantages of online registration

The process of obtaining car insurance online has its pros and cons. They should be carefully studied before deciding on the procedure for its registration.

So, the undoubted advantages of obtaining compulsory motor liability insurance via the Internet :

- There is no need to travel anywhere - you can apply for insurance at any time convenient for you, without adjusting to the office work schedule.

- The cost of electronic insurance is lower, so on the website you can calculate in detail the entire amount you will have to spend.

- Simplicity of the procedure - to obtain e-OSAGO you only need to fill out a small form.

- The ability to make cashless payments in a convenient way without leaving the room.

- No additional services.

- There is no need to go to get the finished document; it will be sent to your email with detailed instructions for use.

With so many advantages, this method also has disadvantages that may seem significant to many car owners:

- Most insurance companies do not conduct large-scale advertising of their services when registering online, which negatively affects the level of knowledge of information;

- due to the inability to check the policy online on the road, lengthy disputes may arise with traffic police officers;

- If in an accident one of the participants has electronic insurance, this eliminates the possibility of drawing up a European protocol and independently resolving the conflict, without the participation of traffic police officers.

For the last two situations, you will have to carry a printed copy of the insurance with you.

Return to contents ↑

○ Insurance companies with online registration of compulsory motor liability insurance

Today, all major insurance companies provide the service of issuing electronic insurance. Smaller companies are also starting to support this function. If you decide to get OSAGO online , you should know the most reliable companies working in this area:

- Rosgosstrakh.

- Ingosstrakh.

- Alpha Insurance.

- Reso Guarantee.

- Renaissance Insurance.

In smaller companies, the service is provided to certain constituent entities of the Russian Federation.

Return to contents ↑

○ What documents are needed

According to clause 3 of Article 15 No. 40-FZ, in order to fill out an application form for insurance, you need data from:

- Passports of the vehicle owner and the policyholder (if these are different persons).

- Car registration certificates or PTS.

- Driver's licenses of persons authorized to drive a vehicle (if limited insurance is taken out).

- A valid diagnostic card.

You also need to consider the need to sign the document. When registering online, an electronic key is used for this, which can be ordered at specialized centers.

If for some reason the entered information does not pass the check against the unified RSA database, the applicant will be asked to scan and send the listed documents to the insurance company’s email.

Return to contents ↑

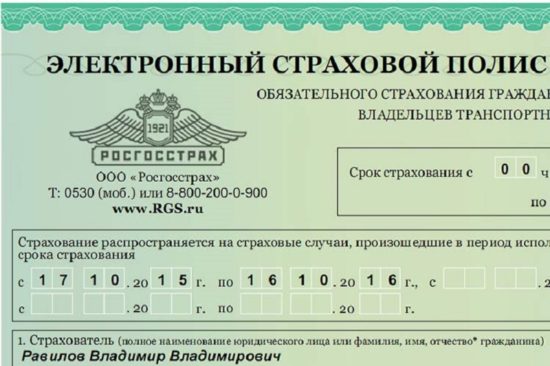

○ Registration of compulsory motor liability insurance online in ROSGOSSTRAKH

To take out insurance with the largest insurance company ROSGOSSTRAKH, you need:

- Register in your personal account on the company’s official website. To do this, you need to enter your email address in the appropriate field and click the “Get password” button.

- A temporary password will be sent to the specified address, which must be entered in the appropriate field in your personal account.

- Then you need to come up with your password and enter it twice in the appropriate field.

- Click the “Save” button and the registration procedure is completed.

- Next, click on the “Calculation and purchase online” field.

- You will be offered an application form for obtaining compulsory motor liability insurance. It must be filled out by entering the information from the above documents.

- After filling out, click the “Calculate” and “Get” buttons if you are satisfied with the cost.

Return to contents ↑

○ Payment for the policy online

Once the insurance is issued, you will be asked to pay for it. Most often, a bank card is chosen for this, but you can transfer money in various ways. So, you will have access to payment through:

- Bank card.

- Payment system Moneta.ru.

- Electronic wallets Qiwi, WebMoney or YandexMoney.

- Banking services: Sberbank Online, Alfa Click, Qbank Svyaznoy Bank, Promsvyazbank, Faktura.ru.

- Bank or postal transfer, as well as using the CONTACT money transfer system.

- Payment terminals: Eleksnet, OPLATA.RU, Federal System City, Moscow Credit Bank, Forward Mobile, CiberPay, Platika, NPO LEADER, ComePay.

- SMS (available for MTS and Megafon operators).

Return to contents ↑

○ What to do after registration and payment

Formally, traffic police officers have the ability to check electronic insurance. Especially for this purpose, a special resource was created on the IMTS of the Ministry of Internal Affairs of Russia, thanks to which employees have access to the database. If for some reason this resource is not available, you can check it on the official RSA website.

In practice, not all patrol cars are equipped with such technical means. Therefore, it is worth printing out electronic insurance to present it to traffic police officers, which will significantly save time on the road.

You can also arrange delivery of the original insurance, which can later be presented for verification.

Return to contents ↑

○ Delivery of the policy

If the applicant expresses such a desire, the insurance company is obliged to give him the original OSAGO.

- “At the request of the policyholder, an insurance policy drawn up on a strict reporting form can be issued to him at the insurer’s office free of charge or sent to the policyholder at his expense by mail. At the same time, the price at which the policyholder pays for the service of sending him an insurance policy drawn up on a strict reporting form is indicated separately from the amount of the insurance premium under the compulsory insurance agreement...” (clause 7.2 of Article 15 No. 40-FZ).

Return to contents ↑

○ Online policy renewal

According to clause 7.2 of Art. 15 No. 40-FZ, electronic insurance can not only be purchased, but also extended. The algorithm of actions here is the same as during registration. Only in addition to the listed documents, you must additionally provide information from your previous insurance, which will be checked against the database.

https://www.youtube.com/watch?v=AxrbUe7Yy0Q

Return to contents ↑

○ Advice from a lawyer:

✔ What if you and your car have not been insured under MTPL for the last year?

The provided data is checked against the unified RSA database, where you can find last year’s information about the applicant. But if you and your vehicle were not insured last year, this information is not available in the system, making it impossible to verify the accuracy of the data. Therefore, in this case, it will not be possible to obtain electronic insurance.

Return to contents ↑

✔ Have your car documents changed?

Any change in personal data or information on the vehicle may make it impossible to issue OSAGO online. It is possible to obtain insurance using old data, but after that you must personally visit the office and record the changes that have occurred in the data. If you skip this step, you risk being denied compensation in the event of an accident.

Return to contents ↑

Buy an MTPL policy in electronic form. How convenient and what are the dangers for the policyholder. Watch the news release on the Katun24 channel about this.

Return to contents ↑

Published by: Vadim Kalyuzhny , specialist of the TopYurist.RU portal

Source: http://TopUrist.ru/article/53880-kak-kupit-polis-osago-online.html

Step-by-step instructions for applying for compulsory motor liability insurance through State Services online in 2018

Every driver is required to have an MTPL policy; the document insures motor third party liability to other road users. Registration of a policy in the traditional way involves contacting the insurance company, talking with employees, considering additional services, and filling out paperwork.

In an effort to simplify the procedure for obtaining compulsory motor insurance, the state added a service to the State Services portal. Subject to simple conditions, everyone can receive an electronic MTPL without leaving home.

Is it possible to

The Government Services portal is a modern system on which almost all services provided by Russian government authorities operate. You can get insurance from companies that have already introduced new technologies into the process.

A citizen has the right to choose: either receive an electronic policy by email, or leave an application to the insurance company to receive a traditional compulsory motor liability insurance policy. The documents have the same legal force.

To register for compulsory motor liability insurance, a citizen must have a confirmed user record. It is activated by a code issued by the Pension Fund. You will also need passports, a driver's license and knowledge of the insurance company where the policy will be issued.

Some insurers send a ready-made MTPL a few hours after receiving an online application from the website, after checking the entered data.

What services does the driver portal provide?

In addition to registration of compulsory motor liability insurance, the portal has a system of discounts for drivers using electronic services:

- If a citizen has not yet received a driver's license, registration for the exam is available online. The citizen will automatically receive a 30% discount on state fees. Only a new driver's license is considered, not a renewal;

- If a person has passed the driving test and is going to buy a new car, then the vehicle can be registered online. Documents are sent by email, copies are stored in the applicant’s personal account. The process takes up to 30 minutes;

- If your driver's license has been lost, State Services offers to submit an online application to restore the document. The citizen chooses any traffic police department and the day he receives his license. It is enough to provide the details of your passport and lost driver’s document, then go to the selected branch to get a new license. A 30% discount on state fees is automatically calculated.

Where can I get a policy online?

The state has obliged all insurance companies to develop systems for issuing electronic policies. In 2018, 15 largest companies offer e-MTPL.

Some of the companies that consistently and quickly process documents include:

| Tinkoff Insurance | The insurance company has 24/7 customer support and answers any questions about compulsory motor liability insurance. Registration of the policy takes place in a few minutes. If a citizen already has a policy from this company, he will receive a discount on CASCO (combined with KBM). In the past, electronic policies were issued only to residents of Moscow, St. Petersburg and the regions, as well as the Novosibirsk region, but since 2017 they have become available to residents of all regions |

| Alfa Insurance | One of the oldest companies, operating for more than 20 years. It has the highest reliability rating and operates throughout Russia. Issues e-OSAGO within 30 minutes, documents are sent by mail with the signature of a company employee. New clients can apply for a policy online only in Moscow. If a citizen already has insurance from this company, he can get a new one anywhere in the world |

| VSK | The questionnaire is filled out in three parts, each separately checked by the RSA. The process takes longer than with other insurance companies, but the chance of error is zero. If a citizen fills out one part incorrectly, he will not be able to move on to the next one. |

| Renaissance Insurance | Issues electronic policies for residents of Moscow, St. Petersburg, Yekaterinburg and the corresponding regions. It is possible to obtain an MTPL policy only by concluding a CASCO agreement. The document will be sent by mail on the day the application is submitted (or will be delivered free of charge by courier in a few hours) |

| Liberty Insurance | The company operates in most regions of Russia. One of the recent companies on the insurance market, it has positive customer reviews. Electronic compulsory motor liability insurance is issued in the Moscow, Leningrad, Perm, Tver, Oryol regions and Krasnoyarsk Territory. The list is constantly updated |

Procedure

Step-by-step instructions on how to apply for compulsory motor liability insurance through State Services online in 2018 look cumbersome, but in fact it takes no more than 30 minutes. The main thing is to enter the data correctly and provide documents.

Every driver can go through this procedure:

- register on the portal, create an account, for this you will need:

- go to the main page of the site;

- click the “Registration” button;

- enter your full name, phone number, email;

- A code will be sent to your mobile phone, which is entered into a special window on the website.

- To choose an insurance company that will issue a policy, for this you need to:

- go to your personal account;

- go to the “Service Catalog” tab;

- select the “Transport and Driving” section;

- go to the item “Electronic insurance”;

- Click on the “e-OSAGO” button.

- if a citizen does not know which company to choose, he can fill out several forms from different companies, look at the conditions, and make his choice;

- fill out an application for compulsory motor liability insurance, enter the following information:

- internal passport;

- vehicle make and model;

- series and number of the vehicle passport;

- year of manufacture of the car;

- state signs;

- engine power in horsepower.

- If other citizens are included in the insurance, you will need to fill out an additional form:

- Full name of each person;

- their driving experience;

- driver's license series and number.

- the system will automatically check the information, if everything is correct, a new page will open;

- The cost of insurance and payment options will appear on the form; you can choose any of the available methods (bank card or electronic wallets);

- receive OSAGO.

A citizen has the opportunity to choose how he wants to receive the policy:

- A letter with the organization's seal by email. OSAGO is printed on a printer and has the same force as a traditional document.

- Receive by courier to the address indicated on the portal. Not all insurance companies offer this service. Some companies ask for additional payment for home delivery.

- Go to the insurer's office and receive the document from the employee.

What documents are needed

One of the advantages of applying for compulsory motor liability insurance through State Services is the minimum package of documents. The rest of the information is stored on the portal and filled in automatically.

The citizen will need:

- car registration certificate;

- driver's licenses of citizens who will be included in the insurance.

Price

Registration of compulsory motor liability insurance online means paying for the insurance itself, which costs the same as the policy would cost if received at the office of an insurance company. There are no additional payments. There is no state fee for the document.

Useful tips

If a citizen applies for e-MTPL for the first time, it is recommended to take into account some points:

- When a person takes out insurance for the first time, it is advisable to go to the office of the insurer. There is no data about the citizen in the RSA database yet; State Services will not be able to calculate the cost of the policy.

- Not all insurance companies provide information about discounts and benefits. It is recommended to obtain an online policy from a company that will calculate the CBM. Otherwise you will have to pay the full cost of insurance.

- Recheck the entered data. The system should detect errors and issue denials, but flaws can slip through. Then you will have to go to the insurance office and write an application to correct the information.

- When e-OSAGO arrives in the mail, it is recommended to check its availability in the RSA. The system is still new, insurers may not send data to the database. There will be problems getting a discount in the future.

Registration of insurance through State Services occurs without the participation of intermediaries or employees of insurance companies, which saves the applicant’s time and nerves.

The probability of policy falsification is zero. The state plans to improve the service, making it more accessible and understandable.

Video on the topic:

Source: https://autouristpro.ru/poshagovaja-instrukcija-kak-oformit-osago-cherez-gosuslugi-onlajn/

How to obtain an electronic MTPL policy via the Internet?

An MTPL policy is a document that absolutely all owners of vehicles in the Russian Federation must have.

Lack of insurance threatens the car owner with a hefty fine in the amount of 500 to 800 rubles.

You can store the policy along with the documents, but you can receive it in the standard way or online.

To use the last option, you need to understand how to issue an electronic MTPL policy.

Starting from 2017, all insurance companies are required to issue an electronic version of OSAGO to the client upon request.

The development of electronic document management allows car owners to issue compulsory motor liability insurance electronically, however, to carry out such a procedure, they should carefully search for a suitable partner.

The service for obtaining electronic insurance has been operating for more than two years now. This is especially convenient for residents of small cities, although in megacities they increasingly prefer electronic documents.

The e-policy has a number of advantages:

- 24-hour registration – now car owners are not tied to the insurance company’s work schedule.

- The safety of the document is ensured - the possibility of accidentally throwing it away/losing it or forgetting it at home is eliminated.

- Registration anywhere – there is no need to waste time visiting the company’s stationary branch to issue a document.

- Availability of electronic calculators - this option allows you to calculate the cost of the policy in advance and plan your expenses.

Registration of an electronic MTPL policy often brings future owners additional benefits and bonuses. Many insurers, in order to attract online clients, are ready to make discounts and organize profitable promotions.

There are also disadvantages to this design:

- Sometimes RSA databases contain incorrect data, and therefore it is not possible to issue a document.

- The client independently enters information about himself and the vehicle, and therefore errors are possible, and sometimes the opportunity to complete a transaction is blocked. If an error is made during the registration process, you will need to find out how to make changes to the electronic OSAGO policy.

- The need to check the policy by traffic police officers. Such manipulations require some time.

Stages of obtaining an e-policy

To understand how to obtain an electronic MTPL policy via the Internet, you should follow a simple scheme.

- Choose an insurer.

- Complete a simple registration in your client account.

- Calculate the amount of the insurance premium and study the conditions for obtaining an e-document.

- Fill out an application.

- Wait for the results of the RSA check.

- Make payment to the details specified by the company.

- Provide the required package of documents (previous OSAGO policy, driver’s license, owner’s passport, vehicle registration certificate).

- Receive the insurance policy and all accompanying documents to your email address.

You should choose only a trusted company as a partner. Before signing a document, you should check the eligibility of a potential partner, evaluate the stability of the company and the number of clients, study the reliability rating and reviews of real clients!

Video: Buying electronic insurance online! In just 5 minutes

Several insurers provide their services at once. Among the leaders:

- "Rosgosstrakh" has a reliability rating of "A++", the company accepts for insurance any vehicles that have passed technical inspection.

- “SOGAZ” has an “A++” reliability rating, quickly completes transactions, has impressive work experience and a lot of positive reviews.

- Ingosstrakh has a reliability rating of A++ and offers favorable conditions for related services, including e-CASCO insurance.

- Tinkoff Insurance has an A++ reliability rating, is engaged in the development of Internet technologies, is considered one of the industry leaders, and is quite reliable.

- “Alfastrakhovanie” has a reliability rating of “A++”, extensive experience is supported by the efficiency of service provision.

These are undoubted leaders, but there are many proven and reliable companies on the insurance market.

Important points

To print or not?

Many people are interested in whether they need to get the original e-policy and whether they need to print out the electronic version.

Alteration

Sometimes you need to make adjustments to the document or find out how to add a driver to the electronic MTPL policy. It is no longer possible to resolve this issue on your own.

To do this, you will need to contact the company with which the contract was concluded . The same scheme of action is provided for the case when it is necessary to terminate the contract.

Prompt registration of an insurance policy through online points opened by companies is quite simple. By learning how to make and receive an e-policy, you can save time without violating the requirements of the law.

You will be interested in:

Source: http://pravo-auto.com/kak-oformit-elektronnyj-polis-osago/

How to get MTPL insurance for a car via the Internet in 2017 - 2018?

Since July 1, 2015, all car owners have the opportunity to purchase a compulsory motor liability insurance policy without standing in long queues, but by applying for it via the Internet. At the same time, many questions arise about how to apply for an MTPL insurance policy online. It is also called e-osago, which means electronic version.

In fact, when trying to register on some popular sites, so-called bugs and errors were noticed when filling out the form. The functionality is quite new for many, and apparently not everyone has had time to test the correct operation.

So, on one site (Consent) - the fields were filled out correctly, but he still complained that there was an error. So think about what’s wrong...

And if you encounter any errors when applying for a policy, write below about them...

Of course, this doesn't mean everything is so bad. Many people manage to get insurance online on the first try. And this, of course, made obtaining a policy much easier.

There is no need to queue, stand in them, and also receive completely unnecessary additional insurance. So-called additional services, which are supposedly mandatory, and without them you cannot get a policy.

Fraud in simple words and deception of drivers.

It should be taken into account that new rules have been introduced for owners of compulsory motor liability insurance, one of which allows the insurer to put forward a right of recourse against the person who caused the harm.

We learn how to take out MTPL insurance online, on the government services website

There are several ways to obtain electronic insurance. You can do this directly on the auto insurer’s website, but you can also do it through the State Services website. Today it is a very popular platform for performing a wide variety of transactions - not only insurance.

The algorithm of actions on the site is simple. In general terms it looks like this:

- Log in (log in with your username and password)

- We enter the “Services” section - the “Transport and Driving” subsection

- Find the item “Electronic insurance”

- In the list of insurance companies that opens, select the appropriate one. It is best to choose the one with which you already have positive experience of cooperation.

- You will be transferred to the website of this insurer, where you will have to fill out an application template (this is data about the car, owner, etc.).

- The site will check the information and, if everything is correct, you will be redirected to the payment page. Usually everything is paid for immediately via Internet banking from a card.

- When the payment is confirmed, the data will be sent to the Unified Information Center and the traffic police database, after which an electronic policy will be sent to the email address specified by the client.

So, let's look at this design process in a little more detail.

Registration on the State Services website

You can create an account on State Services of three types: simplified, standard and confirmed.

Simplified is a regular registration on the site, like on any other.

You receive a personal account with limited capabilities. These are mainly informational, traffic police fines and some others.

To get more features, you need to create a verified account.

To do this, you must enter your passport data and SNILS number in your personal account. The system will check this data and, if everything is correct, your standard account will be activated.

Thanks to it, you can use confidential database services, such as retirement account statements, medical records, tax debt checks, etc.

To make your identification more reliable (to avoid any misunderstandings with your data), you can get a verified account.

You can upgrade your status to verified in several ways:

— Personal visit to the public service center

— Introduction of electronic personal identifiers - use of an electronic signature key

— Receiving an activation letter by mail

We choose any convenient method, activate the status to confirmed and, as a result, get access to the entire list of services on the site.

Registration of e-OSAGO

So, we registered on the State Services website. Now you can start applying for the policy itself.

After authorization, follow the following path:

“Service Catalog” tab – “Transport and Driving” section – “Electronic Insurance” – “e-OSAGO”.

In the list of insurance companies that opens, select the one that suits you best. Do not forget to prepare a civil passport, PTS and STS and a driver’s license, both yours and those of those whom you are also going to include in the insurance.

After filling out the template, you will be redirected to the payment page, after which a package of e-OSAGO documents will be sent to you to the specified email address.

How to obtain an MTPL policy via the Internet?

As mentioned earlier, you can apply for compulsory motor liability insurance not only on the State Services portal, but also directly on the insurer’s website. This is convenient because if you have been working with this company for a long time, then you have your own personal account where you can manage the services offered. In addition, when applying for compulsory motor liability insurance, you will not be forced to impose additional services, as when visiting an office.

There are a lot of insurance companies. If you are already a client of one company and you are satisfied with it, then you do not need to search the Internet for sites of other companies. If you are applying for compulsory motor liability insurance for the first time, then it is advisable to ask friends and acquaintances who are already insured somewhere about this company, its advantages and disadvantages.

One of the most common insurance companies is ROSGOSSTRAKH.

An example of applying for car insurance via the Internet at ROSGOSSTRAKH

So, we decided to purchase an MTPL policy on the ROSGOSSTRAKH website. To begin with, we will prepare all the necessary documents and data, so that later during the registration process we do not have to run around and look for anything.

What we need:

— Previous OSAGO policy

— Vehicle Registration Certificate (VRC)

— Passport of the owner of the vehicle (PTS)

— Driver’s licenses of all those whom you want to include in the policy;

— Email for registration;

— Bank card for paying for compulsory motor liability insurance.

We start by registering on the ROSGOSSTRAKH website if this is your first time, or logging in if you already have an account.

Enter your email address and click the “Get password” button. An email with a password will be sent to the specified address, which must be entered for further registration. This is a temporary password and in the next step you will be asked to come up with a permanent one.

Next, we go to the data entry page, according to which the cost of compulsory motor liability insurance will be calculated.

Having entered all the data, click the “Calculate” button. The program checks the correctness of the data using the SAR database. If there is a discrepancy, an error will be thrown. Therefore, try to contribute carefully, without rushing.

After checking, a window with the cost of the policy will appear:

At the next stage, we enter data about the car, which we take from either the STS or the PTS. You can also use your previous insurance data.

Click the “Next” button and proceed to entering data about the owner of the car.

In addition, you will need to enter data from your previous MTPL policy.

Click “Next” and confirm the entered data, after which the program begins checking them through PCA.

The verification may take some time. After it expires, the program will either skip you further if there are no errors, or give you this same error. Most often this is what happens.

This happens most often due to a discrepancy between the entered data and the data provided on the RSA website. Any fields that are incorrect will be highlighted in yellow. Having corrected them, you will go further to the payment page.

Payment is made from a bank card. Once the payment is confirmed, you will receive a policy via email. You can print it out and take it with you.

You don’t have to carry a paper version, but you should have an electronic version of it – the number. When the inspector asks, you give the number and he punches it into the database.

But it is still better to carry a paper copy, since it may turn out that not all patrol officers have access to the database.

OSAGO insurance policy cost calculator 2017. where is it located on the websites?

Before applying for compulsory motor liability insurance, any car owner is looking for a calculator for calculating it. Each insurer calculates it on its website when filling out an application, but there are also so-called calculators that are recommended to be used. One of these can be found by following the link http://pddmaster.ru/calc-osago.

Below are screenshots of the websites of the most popular insurance companies

ROSGOSSTRAKH

The OSAGO calculator on the ROSGOSSTRAKH website has already been discussed above. Calculation occurs when you fill out the form step by step after logging in to the site.

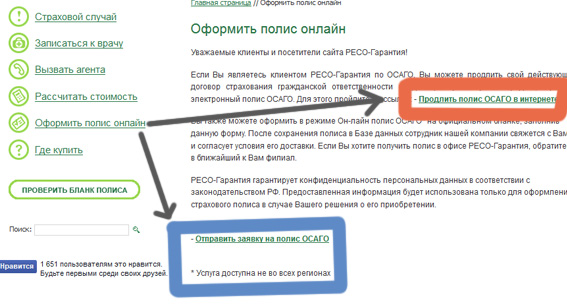

Reso

Alfa insurance

Only part of the screenshot is shown here, since the form is long, but the design is similar to ROSGOSSTRAKH with authorization

Ingostrakh

Sun

To purchase a policy here, you also need to either log into your account or register.

Sogaz

Consent

Yugoria

Here, too, before calculating the cost of compulsory motor liability insurance, you need to register

Max

Intouch

As already mentioned, everyone is free to choose a suitable company. The main thing is to be careful and everything will be fine.

Good luck on the roads!

Having problems or have something to tell? Share below...

Source: https://leadinlife.info/straxovka-osago-cherez-internet.html