Luxury tax, list of cars, calculation! +Calculator

Since January 1, 2014, a new concept has appeared - “luxury tax”, due to changes in the tax code, when calculating transport tax on cars costing more than 3 million rubles (clause 2 of Article 362 of the Tax Code of the Russian Federation).

“Luxury tax” is a transport tax increased by a factor depending on the cost and year of manufacture of the car. In fact, you are forced to pay for the right to use a more expensive car. This is more an element of regulation of social tension than a way for the state to generate income, due to the small number of such cars out of the total number.

The organization authorized to compile a list of cars for which an increased transport tax is charged is the Ministry of Industry and Trade.

The Ministry of Industry and Trade requests from manufacturers or authorized persons information on brands, models and basic versions of passenger cars, the recommended retail price of which exceeds 3 million rubles.

The average cost is calculated based on the recommended retail prices of the basic versions as of July 1 and December 1. The MSRP data provided for base versions is used to calculate average vehicle prices.

The change in the dollar exchange rate and the rise in car prices have made it ridiculous, so in 2017, “luxury” cars already include: Mercedes-Benz Sprinter 319 CDI, C 180, Toyota Highlander, Range Rover Evoque, BMW 4-series, 5-series.

Depending on the price and year of manufacture, all cars are divided into 4 categories. Each category has its own increasing coefficient. The table shows the luxury tax coefficients.

Average price of a car Year of manufacture passedIncreasing factor| from 3 to 5 million rubles. | no more than 1 year | 1,5 |

| from 3 to 5 million rubles. | no more than 2 years | 1,3 |

| from 3 to 5 million rubles. | no more than 3 years | 1,1 |

| from 5 to 10 million rubles. | no more than 5 years | 2 |

| from 10 to 15 million rubles. | no more than 10 years | 3 |

| over 15 million rubles. | no more than 20 years | 3 |

The list of cars subject to increased tax is annually provided by the Ministry of Industry and Trade on its website no later than March 1st. If you have any difficulties or doubts about choosing a premium car, then we can help you buy a car.

You need to multiply the number of horsepower by the transport tax rate and the increasing factor.

Example: Lexus LX570 (367 hp) 2015 the owner is registered in Moscow. The tax is paid for 2017.

Calculation: Horsepower rate 150 rubles per 1 hp, increasing factor 1.1 (since no more than 3 years have passed since the year of manufacture, but more than 2 years) we get: 367 X 150 X 1.1 = 60 555 rub.

Underpricing in a sales contract

It doesn’t matter at what price you purchased the car, the tax office, when calculating it, will refer to the list of cars generated by the Ministry of Industry and Trade; if your car is on it, then an increased transport tax will be charged.

Source: http://dp-auto.ru/nalog-na-roskosh-avtomobili/

Luxury tax 2016. List of cars, calculation example

According to paragraph 2 of Article 362 of the Tax Code of the Russian Federation, each owner of a car that falls under the scope of this legislative act is required to pay an increased transport tax. This norm came into force in 2014. People called it the “luxury tax.”

This article will provide an example of calculating the luxury tax, as well as a list of cars that are subject to it in 2016.

Luxury tax calculation

Many Russians mistakenly think that this forced payment is independent. It is a transport tax increased by a certain factor. To calculate it, it is necessary to rely on the coefficient specified in the above-mentioned legislative act.

The luxury tax itself is calculated quite simply: the transport tax, which is determined by the Federal Tax Service (FTS) for each region separately, is multiplied by a coefficient corresponding to the age and cost of the car.

For example, you purchased a 2013 Audi A8 L W12 quattro 3.0 TFSI. The purchase took place 6 months ago. Its average cost from the manufacturer is 5,420,000 rubles. Engine power – 310 hp. Region of residence: Moscow.

The tax calculation formula is as follows: NS*LS*MV/12*PC

Where:

TS – tax rate for your region (for Moscow and a gasoline engine is 150 rubles);

HP – engine power in horsepower;

MV – the number of months of car ownership (applies only if you have owned it for less than a year);

PC – luxury coefficient, which increases tax (a car costs from 5 to 10 million rubles and its age is less than 5 years – 2.0).

Thus, your transport tax will be: 150*310*(6/12)*2.0= 46,500 rubles .

As for the average market cost of transport, the determination of this indicator is under the jurisdiction of the Ministry of Industry and Trade. In its practice, this ministry uses two ways to evaluate a car:

-

Receiving special price lists from official representatives of global transport brands in Russia.

-

Based on catalogs of recommended prices for the same brands.

Preferential group of citizens

There are several social strata of the population that are completely exempt from paying luxury tax. The following citizens fall under this rule:

- Parents of large families.

- Disabled people (regardless of the degree awarded).

- Veterans of the Great Patriotic War.

- Participants in combat operations.

- Heroes of the Russian Federation and the USSR.

Although this benefit can only be used if the car’s power does not exceed 200 hp. Moreover, there are very few vehicles in Russia that meet these requirements and cost more than 3 million rubles.

List of cars

Every year, no later than March 1, the Ministry of Industry and Trade is obliged to publish a new list of cars that are subject to the “luxury tax” law.

It is worth noting that due to the sharp devaluation of the national currency, the new list of transport for 2016 has become almost twice as long as the previous one.

After all, the price of the car in dollars remains the same, but to calculate the tax, the cost in rubles is taken.

A complete list of cars for which you will definitely have to pay an increased transport tax in 2016 is available to you in the table, which can be opened by clicking on the picture below.

If the make and model of the car you own is on the list, then contact your territorial office of the Federal Tax Service to calculate the full amount of tax, since it will depend on the region of residence.

It is also important to mention that the average cost of transport is determined by the Ministry of Industry and Trade based on information received twice a year. That is, if, according to the recommendation of the branded manufacturer of your car, its cost as of July 1 was 4.7 million.

rubles, and as of December 1 it is already 5.1 million rubles, and its age from the date of manufacture is 1.5 years, then your coefficient of increase in transport tax will not be 2.0, but 1.3. This is due to the fact that the Ministry of Industry and Trade calculates the average value: (4.7+5.1)/2=4.9 million.

rubles

Olga Sevastyanova specially for OccupyOnline.ru

Source: https://ZanimayOnlayn.ru/article/finansovye-sovety/spisok-avtomobileynalog-na-roskosh-2016-primer-rascheta.html

Luxury car tax: how to calculate

Since 2015, an additional tax levy, the so-called “luxury tax,” has become relevant in the country. Considering the number of various contributions to the state that existed previously, the significance of the event cannot be underestimated. In this material we will discuss the luxury tax on cars, and in general terms we will describe its imposition on real estate.

We are talking about the imposition of additional deductions:

- luxury real estate titles;

- expensive and high-status vehicles.

Luxury car tax

The significance of the introduced fee

The main list of tasks that the new contribution to the countries' budgets must perform has been named by the government. This:

- regulation of cash flows circulating within the country, as well as changing their focus on the development of certain sectors of the country’s economy;

- preventing corruption and increasing the amount of funds flowing into the state treasury.

Today we are talking about taking funds from the population, whose well-being exceeds the acceptable limits, from very wealthy people who prefer to travel by expensive transport and live in luxury real estate. Each item in the possession of these people may not be in a single copy.

If we consider the list of transport subject to taxation, then within it you can find the following items:

- cars whose price is in the range of three million Russian rubles;

- vessels sailing on water, that is, yachts, boats and boats, except for ordinary names, the total length of which is less than 6 meters, for them the tax fee is 10% of the existing minimum;

- aircraft, the tax rate for them is the same as for water vessels.

As we have already mentioned, if the price of a car exceeds three million rubles, the car is subject to luxury tax deductions in favor of the state treasury.

In order to accurately calculate the amount due to the country, it is necessary to use increasing coefficients, the value of which is directly dependent on the current price of the car, as well as the year of its manufacture.

Let's look at the existing increasing coefficients for 2017 in the following tables.

Table 1. Coefficients for vehicles whose price ranged from 3 to 5 million Russian rubles

Age of the vehicleCorresponding coefficient| Less than 12 months | 1.5 |

| From 12 to 24 months | 1.3 |

| From 24 to 36 months | 1.1 |

| Over 36 months | 1 |

Table 2. Coefficients for vehicles whose price ranged from 5 to 10 million rubles

Age of the vehicleCorresponding increase factor| Less than 5 years | 2 |

Table 3. Coefficients for vehicles whose price was 10 million rubles and above

Age of the vehicleCorresponding increase factor| Up to 10 years | 3 |

In addition, there is a whole list of cars, their makes, models, capacities and other characteristics that are used as a guide to the taxation of luxury vehicles.

Video - Luxury tax 2017: list of models

How is luxury car tax calculated?

The main thing that taxpayers who own luxury vehicles need to remember is that the required type of tax does not exist separately; it is carried out in the form of an additional rate, by which the transport tax is subsequently multiplied.

How to calculate the luxury deduction for owning an expensive vehicle

The data used for the calculation is obtained from the company that produced the vehicle. It is also possible to use a product catalog for this purpose, which indicates what is recommended for each model. The average cost of cars is calculated every twelve calendar months by the Ministry of Trade and Industry of the Russian Federation.

The increased vehicle tax or luxury tax is calculated using the following formula:

Where “A” is the number of “horses” in the engine of the desired vehicle, “B” is the tax rate for a luxury car established in the region, “K” is the increasing coefficient of a specific type of car, found using the data indicated in the tables above .

Luxury tax benefits for vehicles

Let's talk about categories of benefit citizens who are partially or fully exempt from paying the required contribution to the state treasury.

What benefits exist for the required deduction?

However, there are certain categories of citizens who are eligible to receive a full exemption from the luxury car tax. However, these are the people who usually do not have the luxury of:

- people with disabilities of any group;

- veterans of the Great Patriotic War;

- citizens who have undergone combat operations;

- persons who have the status of a hero of the country, both the Russian Federation and the Soviet Union;

- parents raising a large number of children and officially recognized as having many children.

There are ways that will allow you to avoid payments for this type of tax deduction, however, it is in your interests that they correspond to reality, otherwise you can earn not only an administrative penalty in the form of a large fine, but also a criminal one, due to the acquisition of the status of a willful defaulter. Let's consider the options:

- if the car is suddenly stolen, you must submit a corresponding application, until it is found, the tax will not be charged to you;

- a luxury car can be converted for use by persons with disabilities who are unable to drive in a conventional manner due to, for example, limb injuries;

- Registering a car with a company involved in preparing the country for the World Cup in the coming year will also avoid taxes.

Luxury deductions for real estate

The luxury property tax is also an increased property tax. Payers according to the standard type are all individuals who own certain types of real estate included in the list of objects subject to taxation.

Not only cars, but also real estate can be luxurious. Some have both

This type of deduction also provides for the availability of benefits available to specific categories of citizens. Among them:

- heroes of the country;

- people receiving pension benefits in accordance with the procedure established by law;

- military veterans and others.

You can receive an exemption from payments for one property in your possession. If there are several of them, you must select the one to which the benefit will apply.

Let's consider the list of property subject to taxation in favor of the country's budget:

- apartment in an apartment building;

- part of the apartment, that is, a room;

- cottage;

- residential building within the city or outside it;

- townhouse;

- premises used for household needs;

- country house;

- place for storing vehicles.

A citizen can choose an object from which tax will not be deducted independently, otherwise this decision will be made for him by a representative of the Russian tax service in charge of the case. To notify the inspectorate of your choice, you must submit a corresponding application before the end of October of the twelve-month reporting period.

It is important to understand one thing. The luxury tax on real estate, in contrast to the collection in the same direction on expensive cars, has recently begun to concern almost every citizen of the country who owns a plot of land.

The fact is that until recently, the amount of tax was calculated according to the inventory value of a real estate property, be it a cottage with a plot of land, or an ordinary house.

Now, accounting is carried out according to the cadastral value, to which is added the price of the plot, which varies depending on its location.

It turns out that a “luxury” subject to additional tax can be a dilapidated home, which is located in a good location with expensive land. The final tax deduction from such an object will be significantly higher than that of a good cottage located in a place with inexpensive land areas.

Municipal administrations have the right to independently differentiate luxury tax rates. This has led to the fact that in some localities “luxury” worth a million rubles is subject to taxation. It turns out that almost every resident who owns property that is not at all luxurious, sometimes downright old and dilapidated, will have to pay such a tax.

Let's sum it up

The luxury tax itself is not a separate deduction; it has actually become an increased amount of existing standard fees in favor of the state. The level of corruption and the ability to determine the rate at the local level often leads to extortions that worsen the well-being of already poor citizens.

Additional fees will hit the pockets of the middle class quite significantly

In the field of taxation of motor vehicles, however, it remains not so noticeable, since the amount added to the main charge is not large for owners of really expensive cars.

However, the middle class, who managed to purchase cars before their prices increased several times in recent years, will have a hard time. In addition to motor transport, means of transportation in the air and water are subject to taxation.

The list of models subject to the withdrawal of additional amounts is constantly increasing, every year, increasing to two hundred or more additional items.

Carefully monitor existing changes in order to keep up with paying taxes, otherwise you risk finding yourself in the status of a willful defaulter and being punished for an offense in the form of a large fine or even more severe.

Luxury car tax calculator

Source: https://nalog-expert.com/oplata-nalogov/nalog-na-avto-na-roskosh.html

Which cars will be subject to luxury tax in 2018?

Increasingly, deputies and officials are talking about the desire to increase taxes on expensive cars. It is expected that such a measure will fill the budget. Read on if you want to understand everything. In 2017, the list of cars was again replenished with new brands.

One of the clients asked for advice 2 days ago. He decided to change his car to a more expensive one. He wants to buy it for 4 million rubles. I told him that cars over 3 million have recently been subject to a higher tax rate. This client is currently reflecting on this information.

I think you have also heard from the news or conversations about the luxury tax. In this article I have collected the most useful information on this topic.

Those models that last year cost 2.5 million rubles now cost more than 3 million this year. Every year the number of motorists forced to pay a higher tax rate will increase.

Remember that there is no single list of cars that is registered once and for all. Each year, on March 1, this list is subject to change. For example, this year 90 cars were added. This happens because car prices rise every year. There are currently 279 cars on this list.

The list includes all kinds of car models and brands. There are both cars and SUVs here. Look, maybe your car is here too.

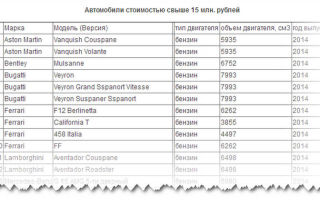

Expensive cars from 5 million

Below is a list of luxury and business class cars. If you are the happy owner of such a car, most likely, your life is good and you are not particularly interested in the amount of taxes.

But to make the article complete, we are attaching a list of these machines. In 2017, it again included several new cars. In general, the situation in this market is constantly changing, as prices rise from year to year.

I wouldn’t be surprised if in 5-10 years all cars will cost 5 million rubles or more.

Calculation

The luxury tax is not a separate tax, as some people think. In essence, this is simply the rate by which the transport tax will need to be multiplied. This rate is calculated depending on the life of the car and its price.

[text_vnutri2]

Tax authorities take information about the cost of a car from two sources.

- In the first case, prices are taken from representative offices in Russia. The cost of their cars is stated in a separate price list for each configuration.

- The second case is when there is no brand representative in Russia, and the car is imported from abroad. The price is taken from the catalog of recommended retail prices. All brands make such catalogs.

By the way, the average cost of a car should be calculated by the Ministry of Industry and Trade. Remember that it is recalculated annually and does not depend on the price at which you bought it.

There are 4 categories of rates and they depend on the price of the car:

- the cost of the car is from 3 to 5 million rubles;

- the cost of the car is from 5 to 10 million rubles;

- the cost of the car is from 10 to 15 million rubles;

- the cost of the car is from 15 to 20 million rubles.

Also, this ratio will vary depending on the regions in the country. In addition, the age of the car will also play an important role.

The rates differ in the following order:

- A rate of 1.1 will apply to cars whose price is from 3 to 5 million rubles, the car was produced no later than 3 years ago.

- A rate of 1.3 will apply to cars whose price is from 3 to 5 million rubles, the car was produced no later than 2 years ago.

- A rate of 1.5 will apply to cars whose price is from 3 to 5 million rubles, the car was produced no later than 1 year ago.

- Rate 2 will apply to cars whose price is from 5 to 10 million rubles, the car was produced no later than 5 years ago.

- Rate 3 will apply to cars whose price is from 10 to 15 million rubles, the car was produced no later than 10 years ago.

- Rate 3 will apply to cars whose price is from 15 million rubles, the car was produced no later than 20 years ago.

Some manufacturers have already realized that they can adapt to this tax. For example, the manufacturer of the Land Cruiser, Toyota, set the price for the basic configuration at 2.99 million. Thus, this car is not subject to tax.

For example, on some brands of cars you will now have to pay a tax of 170 thousand rubles instead of 80 thousand.

This will especially affect owners of luxury brands in the first year of operation. This tax also greatly affects car dealers and rental car owners. After all, for each car you will have to pay an increased tax. Some car rental company fleets have already been reduced by 50 percent.

There are myths that you can evade tax if you register it in the name of a minor or lease it. This is not true, you will have to pay anyway.

Used cars

This law also applies to used cars. Pay attention annually whether your car is on the list or not. If it is, then calculate the rate depending on the year of manufacture of the car.

There are some categories of citizens who are exempt from luxury tax.

- veterans of the Great Patriotic War;

- combatants;

- large families;

- disabled people of all degrees;

- heroes of the USSR and the Russian Federation.

Questions and answers

Ask a question to an expert lawyer!

Alexey

I found myself a good car. Only the seller refuses to indicate the actual cost in the contract. Wants to register a reduced price. He says that in this case he will have to pay less taxes. What to do in this situation?

Answer

I advise you not to enter into an agreement with this seller. It is not known exactly why he wants to do this.

Ivan

How long is the luxury tax on a car?

Answer

It hasn't been in effect for very long. The coefficient varies depending on the price of the car and the period of use. For example, if a car costs 5 million and was purchased less than a year ago, then the tax rate will increase by 1.5 times.

Andrey

I have an expensive car worth 5 million. But she is already 2 years old. Now we urgently need to sell it for 2.9 million rubles. Will the new buyer pay luxury tax?

Answer

If the car is on the list, it will be taxed.

Anna

We bought a car for 4 million, last week we sold it for 3.5 million rubles. Do I need to pay tax?

Answer

Not necessary, since you did not earn anything from the sale. But you will still need to indicate the sale of the car on your tax return. But the new buyer will also pay a luxury tax, since the price of the car is above 3 million rubles.

Vladimir

I want to give a car to my wife. Do I need to pay taxes?

Answer

No, it is not necessary. You are close relatives. Gift transactions between you are not subject to taxation under the law.

Source: https://zakonznaem.ru/auto/nalog-na-roskosh-na-avtomobil.html

Luxury tax 2018: which cars are eligible?

As you know, all vehicle owners in Russia are required to pay a luxury car tax, which is calculated according to a simple scheme: the number of horsepower multiplied by a certain base coefficient.

The amounts may vary, and their value depends on the following basic parameters:

- engine power;

- tax rate for vehicles of various categories;

- the region in which the car is registered.

It is worth noting that this approach does not take into account one important detail - the cost of the vehicle itself - its luxury. Agree that the power is 150 hp.

maybe some budget crossover, such as a Renault Duster, or a Premium car.

And it will turn out that the hard worker who struggles to pay the loan will give the same amount to the state as some businessman who has several prestigious sedans, hatchbacks or even limousines in his garage.

It turns out that everything is not so simple, and there is another type of luxury tax. In this article we will try to understand this type of tax on luxury cars.

What is the tax on luxury cars in 2018 (RUB 3-5 million)?

This type of luxury taxation was introduced at the beginning of 2014. The standards for its calculation are described in detail in Article 362 of the Tax Code. In principle, if you carefully read this article, we see that this is not a new tax, but only an increased transport tax. Special increasing coefficients are being introduced so that owners of expensive luxury cars have to pay more.

First, let's look at the formula for paying luxury tax on expensive cars.

For ordinary motorists, this tax is calculated as:

- no. hp multiplied by the regional rate = amount of payments for the reporting year.

If you have a car that belongs to the category of luxury, then the formula takes on the following form:

- engine power expressed in HP. multiplied by the regional rate and multiplied by the increasing coefficient.

There is no unity in regional rates in Russia, so in each region the indicators for calculating luxury taxation are different.

The increasing coefficients for luxury are as follows:

- 1.5 - for cars produced less than one year ago, worth 3-5 million rubles;

- 1.3 - vehicles of the same value, no more than two years have passed since their release;

- 1.1 - the same cost, but the release date is no more than 3 years.

There is a whole list of cars that fall under these requirements, that is, they cost from three to five million rubles.

How to calculate how much to pay?

Understanding the tax payment plan is quite simple:

- you bought an expensive car, for example a BMW X6 for 4.5 million;

- in the first year, you calculate the tax amount using a simple scheme and additionally multiply the resulting result by 1.5, that is, you will need to pay one and a half times more than for a cheaper car, but with the same power;

- for the second year the amount is reduced by 0.2, that is, multiply the total amount by 1.3;

- for the third year - by 1.1;

- Well, from the fourth year you pay without an increasing factor.

Tax on luxury cars over 5 million rubles

It is clear that there are people in Russia for whom cars costing 3-5 million rubles do not at all belong to the category of prestigious and luxury. They prefer F-class cars, which are produced to order and come with individual equipment. If you have such a car on your household, then get ready to give much more to the state treasury.

For more expensive cars, the following luxury multipliers apply:

- 2 - cars worth 5-10 million, no more than 5 years have passed since production;

- 3 - cost 10-15 million, produced no more than ten years ago;

- 3 - more expensive than 15 million, release date - up to 20 years ago.

What do these numbers mean?

If you have a new car worth 10,000,000 rubles, then you must pay for it for five years, taking into account coefficient 2, that is, twice as much as for a vehicle of the same power, but not falling into the category of expensive cars. Accordingly, for more expensive cars, an increased luxury tax is levied for ten or twenty years.

These coefficients are also valid in the case of purchasing an expensive used car, and you will have to pay for it according to these coefficients, taking into account the date of its production.

How to determine the value of your car?

It would seem that everything is clear with these figures - the rich should pay more. However, a simple question arises - how is the cost of a vehicle determined, because it is no secret that due to inflation, many people who had dollars in their hands literally became rich (in ruble terms).

In addition, it may turn out that, again due to the fall of the ruble, a car purchased last year at an exchange rate of 36 rubles/dollar will become more expensive this year. The thing is, according to the same Article 362 of the Tax Code of the Russian Federation, it is not the cost of your specific car that is taken into account, but the price of the same car of the same age.

To prevent such confusion and citizens can sleep peacefully, lists of expensive luxury cars are published annually on the website of the Ministry of Industry and Trade. We can only hope that officials will take inflation into account and Ladas and UAZs will not eventually be classified as luxury cars.

List of luxury taxes for cars approved in Russia for 2018:

How is luxury car tax paid?

Payment in each region must be made before a certain date, but in Russia as a whole, the deadline is the first of November. Please note that the entire amount for the previous year must be paid by the first of November of this year. Usually a receipt should arrive in the mail a month in advance. If it is not there, then you need to determine the amount yourself.

You can find out the debt in the following ways:

- official website of the tax service;

- State Services website;

- website of the Federal Bailiff Service.

If we are talking about a legal entity, then the amount of luxury tax for the current year 2018 on cars is paid in advance payments no later than the last day of the month following the reporting month.

Payment can also be made using a variety of methods:

- through electronic payment systems - QIWI, WebMoney, Yandex.Money;

- Internet banking - Alfa-Click, Sberbank-banking;

- through post offices - a reliable method, but the payment will take a very long time to reach the account;

- at the bank's cash desk;

- through payment terminals.

We recommend watching this video:

Source: http://AvtoPravilo.ru/nalog-na-roskosh-kakie-popadayut-mashiny/

Luxury tax: list of cars for 2018, calculation, calculator

In the article, we presented a new list of cars subject to the luxury tax in 2018. The list was taken from the website of the Ministry of Industry and Trade.

Download the official list of cars subject to luxury tax in 2018 (approved by the Ministry of Industry and Trade on February 28, 2018)

Who doesn't pay luxury tax

Some categories of taxpayers are exempt from paying luxury tax to the budget. These include:

How to calculate tax

In order to calculate the tax, you need to determine which group it belongs to and use the appropriate coefficient.

Cars from 3 million rubles. up to 5 million rubles

Vehicle ageup to 1 yearfrom 1 to 2 yearsfrom 2 to 3 yearsover 3 years old| Coefficient | 1,5 | 1,3 | 1,1 | 1,0 |

Cars from 5 million rubles. up to 10 million rubles

Vehicle ageup to 5 years| Coefficient | 2,0 |

Cars from 10 million rubles to 15 million rubles. and higher

Vehicle ageup to 10 years| Coefficient | 3,0 |

Calculate the tax using this formula:

Tax amount = Tax rate x Car power x coefficient from the tables above

Luxury tax calculator

The luxury tax for cars in 2018 can be calculated using the calculator on the Federal Tax Service website.

List of cars that are subject to luxury tax in 2018

The Ministry of Industry and Trade has published a list of passenger cars with an average price of 3 million rubles or more for calculating transport tax for 2018.

Download the list of cars

According to the Federal Tax Service, in accordance with paragraph 2 of Article 362 of the Tax Code of the Russian Federation, the tax on cars included in the List is calculated taking into account increasing factors from 1.1 to 3, depending on the year of manufacture of the car.

The new List includes more than 1,120 brands and models (versions) of cars, such as BMW 340i xDrive Gran Turismo, Hyundai Genesis G90 Royal, Mercedes-Benz Mercedes-AMG GT C. Last year, the List included 909 items, earlier, in 2016, 708.

Calculation of transport tax in accordance with updated information for individuals will be carried out in 2019 when tax notices are sent out. Organizations that have vehicles from the List on their balance sheets calculate the tax independently using increasing coefficients and make advance tax payments during 2018.

Increasing coefficients when calculating tax on expensive cars have been introduced since 2014 and depend on the year of manufacture of the vehicle and its average cost, determined in accordance with Order of the Ministry of Industry and Trade of Russia dated February 28, 2014 No. 316 “On approval of the Procedure for calculating the average cost of passenger cars for the purposes of Chapter 28 of the Tax Code of the Russian Federation."

Source: https://www.26-2.ru/art/351646-nalog-na-roskosh

Cars subject to luxury tax in 2017

Any state wants to remain in a stable economic position, and for this its budget must necessarily have a positive value. This means that there should be much more income and infusions than expenses, which, unfortunately, does not happen in all countries and not always.

The state is frantically looking for ways to qualitatively “patch” holes in the budget so as not to accumulate external debts, which again fall on the shoulders of taxpayers, which is why in 2014 it was decided to introduce a previously non-existent luxury tax.

Since then, rates for this type of tax have regularly increased, and the rules have become stricter, so it wouldn’t hurt to find out which cars fall under the luxury tax in 2017 in order to finally clarify the situation.

Meaning and functions of luxury car tax

Many were bewildered by the fact that the Tax Code of the Russian Federation did not and still does not mention any law on luxury tax, but its actual effect can be felt by every citizen who purchases a certain type, category and brand of car.

In 2014, there were only about three hundred models subject to the tax, then their number grew to seven hundred, and in 2017, about a thousand makes and models of vehicles can be found on the list of those that are rightfully considered luxury.

Important

In fact, there is no special and separate tax on luxury cars, it is a popular name. There are also increasing coefficients for the transport tax, which has long been the subject of debate and controversy in the government. The TN value for luxury cars is calculated by taking into account the power of the car, its cost, year of manufacture and brand, as well as the region in which it will be registered.

Vehicles that are subject to luxury tax include not only passenger cars, but also water and air vehicles (helicopters, airplanes, yachts, boats, motor boats, etc.).

Previously, it was assumed that this type of state tax collection would be aimed at creating a kind of reserve financial fund, but at this time this idea is not supported by anything legislatively, and the tax under discussion performs the following functions:

- Anti-corruption activities are financed partly from these fees.

- Regulating the flow and distribution of budget funds, supporting the country’s economy in general.

- Improving the quality of taxes to fill government coffers.

- Maintenance, repair, maintenance, as well as construction of new infrastructure facilities.

The introduction of a new fee only has a positive effect on the economic situation of the state, in general.

As for the rest, I would like to respond to those who are dissatisfied with the good old Russian proverb that if you love to ride, you should not forget that you will also have to carry the sled.

It makes sense to present a list of cars to which the luxury tax applies and the formula for calculating it in order to dispel all the secrets and veils, this is what we will do in our article.

Increasing coefficients

So, if the luxury tax is not a separate fee, which we have already found out, it would not hurt to find out how it can be calculated or at least roughly estimated. It’s worth starting with those same increasing coefficients to the basic transport tax rates, which we already mentioned just above. Just two factors-indicators will significantly influence the size of such a multiplier:

- Year of manufacture of the vehicle.

- The cost of the car, according to the official version, in a new form.

By analyzing the information that can easily be found on the website of the Ministry of Industry and Trade, you can easily understand these increasing coefficients and therefore calculate the required tax payment when purchasing and operating a particular luxury car.

From 3 to 5 million rubles

- The coefficient for vehicles less than one year old will be 1.5 units.

- For a car whose service life barely reaches two years – 1.3 units.

- For cars older than three years – 1.1 units.

5 to 10 million

- The size of the increasing coefficient will be exactly 2.0 units if its service life from the date of issue does not exceed five years.

From 10 to 15 million rubles

- If the vehicle is no more than ten years old, the increase coefficient will be 3 units.

Over 15 million rubles

- In this case, the increasing coefficient remains exactly the same as in the previous category and will be exactly three. However, you will have to pay luxury tax for such a car not for ten, but for two decades.

Formula for calculating luxury tax

Having at hand the above tariff schedule, or, rather, a list of increasing coefficients, as well as having found out the basic calculation formula and several criteria for the car itself, you can calculate how much you will have to pay annually, therefore, draw a conclusion whether it is worth purchasing such an expensive vehicle or better will limit itself to something simpler.

Mdv x NS x PC = PTN

Here's a detailed breakdown:

PTN is an increased transport tax, that is, the same luxury tax that you will have to pay in the end.

Mdv is the engine power of the car you have chosen in horsepower.

TS is the base tax rate, which can vary significantly and significantly in different regions.

PC is an increasing factor that should be taken into account based on the year the car was produced, as well as its real value, according to the Ministry of Industry and Trade.

The main reason for increasing tax deductions lies in the financial plane, that is, the higher the price of a car, the more you will need to pay, at least one and a half, or even two or even three times.

This means that even if you buy a car second-hand and its cost is no more than three million rubles, but the official price in the Ministry of Industry and Trade catalog turns out to be much higher, you will have to pay tax, there is no way to hide from this and there is no escape.

Therefore, it is very important to monitor the replenishment of the list of luxury cars, which is growing with every goal, due to soaring inflation and an increase in all prices, not to mention luxury vehicles. Most brands whose models are subject to luxury tax can be limited to a small list:

- Jaguar.

- Audi.

- Land Rover.

- Mercedes-Benz.

- Lamborghini.

- BMW.

- Chevrolet.

- Cadillac.

- Lexus.

- Aston Martin.

- Bugatti.

- Rolls-Royce and others.

You can download the current 2016-2017 list of cars subject to the luxury tax directly on our website and regularly check it before purchasing.

For convenience, it first lists cars that cost three million and more, then those cars that cost five, ten and fifteen million rubles.

The list is constantly being updated, so it is worth closely monitoring the changes so as not to fall into a network of debts, since if you are in debt, penalties may increase, although not large, but for large amounts, very noticeable.

Benefits, discounts and concessions

This type of tax turns out to be really significant and the amounts are far from childish. You can get rid of such extortions over time, when your car is no longer new, but will serve three, five or ten to twenty years faithfully.

True, by then everything may change.

It is, of course, possible to avoid paying the luxury tax on cars in 2017, but to do this you need to belong to one of the population groups listed below, and also document your right to such a discount.

- Parents or guardians of large families do not pay luxury tax and, moreover, may not pay transport tax at all in most regions of our Motherland, about which there is a useful article on the website.

- Veterans of WWII and UBI do not pay luxury tax, even when they own expensive vehicles.

- Disabled people of the first and second groups.

- Recipients of the Order of Glory of any degree, as well as holders of the title of Hero of the Soviet Union and the Russian Federation.

- Liquidators of man-made and radiation accidents and disasters, as well as those affected by them.

- Persons with special services to the Motherland, astronauts and others.

In some regions of our huge country, pensioners are partially or completely exempt from transport tax; therefore, they will not pay luxury tax. This information needs to be constantly checked, because local authorities may change the rules and system for calculating subsidies and providing benefits annually.

Let's sum it up

There are several other cases where the luxury tax is not levied on car owners, and some of them are actively used by some financially unscrupulous individuals.

So, taxes are not charged at all on a wanted car, that is, neither a transport tax nor one that relates to luxury.

It is unlikely that you will be able to cheat here, since there must be official confirmation from the police that the car is indeed stolen and is wanted.

The second option is to register the car not to the real owner, but to an organization, for example, a society for the blind and similar groups.

The third method is based on the fact that people with disabilities do not pay luxury taxes, and therefore vehicles converted for the needs of a person with special needs and disabilities are not subject to such taxes.

It is clear that hiding income and evading taxes will not bring anything good and in the end, most likely, the truth will come out, then you can end up not only with serious debts, but also with a prison sentence, so it is better to avoid such incidents and live honestly.

data-block2= data-block3= data-block4=>

Source: http://autoconsultation.ru/articles/nalogi/avtomobili-popadayushhie-pod-nalog-na-roskosh-v-2017-godu.html