How to check the authenticity of OSAGO by number?

Checking the MTPL policy gives the car owner confidence that in the event of a traffic accident, he will actually receive financial support from the insurance company. If the insurance policy turns out to be fake, its owner will receive nothing. How to avoid this and check the compulsory insurance policy for authenticity, read the article.

OSAGO: what is it for?

OSAGO is a compulsory insurance policy that every driver is required to obtain.

This insurance has the following features:

- Obtaining an MTPL policy is a mandatory procedure. If a motorist purchased a car and did not take out MTPL insurance for it, then if discovered, a fine will be imposed on him;

- In the event of an accident, the insurance company pays for damage to the victim’s car, i.e. OSAGO insurance policy is a compulsory liability insurance policy;

So, if a car owner causes a road accident, the insurance company pays for the damage caused to another car.

If the car owner is not to blame for the accident, then the damage is paid by the insurance of the person who caused the accident.

- The MTPL insurance policy compensates for damage caused not only to the vehicle, but also to the participants in the accident (driver, passengers, pedestrians);

Why check?

Checking the insurance policy for authenticity will save the car owner from the need to create a scandal after an accident and the lack of appropriate payments to the injured party after it, since today there are a lot of fake companies

To avoid fake MTPL, when choosing an insurance company, you need to consider the following factors:

- The time that the insurance company is on the market;

The longer an insurance company exists, the more reliable it will be.

- On the official website of the insurance company you like, you need to study in detail the conditions for the provision of MTPL insurance policies, as well as the company’s current certificates;

- When drawing up a contract for compulsory motor third party liability insurance at the office of an insurance company, carefully read all the clauses of the contract;

- If you are offered to purchase a blank insurance policy form, refuse;

- If an insurance company offers you to buy an insurance policy at a too “budget” price, this is a reason for concern. Fraudsters lure drivers with an economical price tag.

- When purchasing insurance policies, you need to carefully study all the distinctive visual features of the document that confirm the authenticity of the document;

According to Article 327 of the Criminal Code of the Russian Federation, intentional use of a fake MTPL insurance policy may result in criminal liability.

Methods

Today there are three known ways to verify the authenticity of compulsory motor liability insurance:

- Studying the appearance of the policy, i.e. visual check of the policy;

- Checking the license of the insurance company and the legality of their actions in general;

- Checking MTPL policies based on the Russian Union of Auto Insurers (RUA);

Let's consider each method of checking MTPL poles separately.

Self-inspection of the document

- Pay attention to the size of the MTPL policy. If you attach it to a regular A4 landscape sheet, the policy will be 1 centimeter longer;

- The outside of the insurance policies has a green and blue grid;

- If you look at the policy in the light, the RSA emblem will be clearly visible;

- On the back side on the right there is a metallic mesh;

- When examining the policy in detail, you can see small red dots;

- The ink of a genuine insurance policy is of high quality, so no ink marks should remain upon contact with the skin;

- The OSAGO number must be convex;

Through an insurance company

This can be done by finding out the validity status of the organization's license.

So, if the license is temporarily frozen or even expired, then such an insurance company does not have the right to issue insurance certificates.

In addition, the activities of the insurer are verified by checking the competence of the insurance intermediary serving you.

To do this, you need to ask the insurance employee who issues you the MTPL policy for a document confirming the right to conclude an insurance policy.

The document must contain the following information: the full name of the insurance company, passport details of the insurance agent, a list of documents that the agent has the right to issue.

In this way, the activities of the insurer are checked.

Via RSA

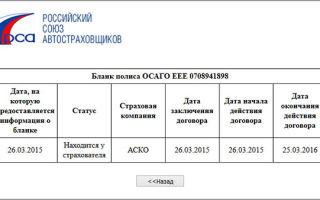

Verifying the authenticity of the policy using the PCA database is possible by entering the MTPL insurance policy number on a special server, which can be found at the following link - http://dkbm-web.autoins.ru/dkbm-web-1.0/bsostate.htm.

Anti-insurance – standard block

In this case, the driver learns:

- Type of form issued by the insurance company;

- Where is this form now located: in the insurance company, with the insured person, or is it completely lost;

- When the contract for the issuance of an insurance policy was concluded;

- When the MTPL insurance policy begins to be valid, when its validity period expires;

Source: http://AntiStrahovoy.ru/kak-proverit-podlinnost-osago-po-nomeru.html

Checking the MTPL policy by car number for authenticity in 2018

Due to the high cost of an insurance policy, there is a possibility of purchasing a fake, especially from agents who can be found in any city. Checking the policy for the authenticity of the PCA is the buyer’s task; its main goal is to find out whether the insurance is real or fake. If you purchase fake insurance, you will not be able to contact the company for compensation.

Where can I buy OSAGO

Information for policyholders and victims can only be obtained if the policy is authentic, which is sold in:

- insurance companies, it is important to have an appropriate license to sell car insurance;

- agents are representatives sent by a company to sell policies. They have a corresponding percentage of the transaction;

- Brokers are like agents; they are also intermediaries.

The danger of purchasing a policy from an insurance company without the appropriate license or fake insurance in the absence of payment when an insured event occurs.

Another risk is that the legislation contains penalties for data falsification. If the traffic police check your insurance, criminal liability may arise.

Such punishment occurs only if there is evidence of intentional use of the document.

Thus, entering the insurance number in the database is a necessary condition for purchasing compulsory motor liability insurance.

Where can you check the MTPL for authenticity?

There are several ways to find out whether your data is entered into the insurance company and whether everything is completed correctly:

- The easiest way is to go to the official website of the RSA (Union of Automobile Insurers of Russia). To check, you must enter the policy serial number, which is indicated on each form. The service requires this code and then click “Check”.

In a matter of seconds, information on the number will be generated and will be provided on the website;

- Through traffic police officers, all you need to do is provide a form. If the answer is negative, a fine may apply;

- Having manually studied the OSAGO policy. Each form has special security marks; they are worth studying, as this will help to draw a conclusion about the authenticity of the document.

How to check the authenticity of OSAGO without the Internet

There are 3 ways to authenticate without going online:

- Ask the traffic police officers. Here you can check your MTPL policy by car number. To do this, go to the nearest stationary post. This technique is dangerous due to the risk of receiving a fine.

In this case, employees may refuse to perform the procedure.

- In the company where the car is insured on the basis of the issued document.

You should go to the company’s office and ask to check the availability of an insurance policy and its conditions;

- Find differences in the issued form from the standard sample, this will indicate that the OSAGO policy is fake.

Distinctive features of the document:

- quality of material for the manufacture of an MTPL policy. The original form was made at a printing house using thick paper. Fake versions use a regular printer and standard paper;

- the presence of watermarks provided by the Russian Insurance Agency with a characteristic logo. You should not contact the insurance company without this sign, because it will be a fake;

- On top of the original OSAGO policy there is a corresponding inscription: “insurance policy for motor third party liability of vehicle owners”, the meaning must be given to the word “owners”. Counterfeit variants often use the word "owner" ;

- The MTPL policy issued from the printing house and recorded in the database contains a special protective grid, which has an individual order and contains 3 colors. This factor is often not taken into account by unscrupulous policyholders;

- the presence of a metallized strip is a reliable identification tool that allows you to recognize a fake at first glance. Fraudsters do not have this option;

- There should be fibers on the surface of the OSAGO, they can be seen in good lighting. Protective fibers will be missing or not visible in any light;

- availability of the series and number of the OSAGO form. The details have a convexity, this can be easily felt when touched. The fake version has no lint. Using low-quality paint can lead to marks on your hand.

What to look for when inspecting your MTPL policy

Online check of OSAGO for authenticity

For faster and more accurate policy verification, you should use tools with Internet access, since there are a large number of them. Even if you don’t have a smartphone or computer with the Internet, you can visit a special club.

There is a single database that will allow you to quickly find out all the information about the policy. In addition to simply having insurance, you can clarify the bonus-malus coefficient and get advice from the company’s specialists.

To carry out the check you can use the following methods:

- Go to the insurance company’s website; almost all policyholders have their own resources. The most popular are Rosgosstrakh, Alfa insurance, Ingosstrakh, RESO.

There is a special section on the company’s website with the appropriate name; you just need to enter the form code and a verification code to protect against robots. If the MTPL policy is invalid, it will be shown in the “Status” section - “Document has lost force.”

- Use the RSA website.

How to check authenticity by OSAGO policy number

A good trend is to provide a link from the insurer’s website to the PCA database, which contains all the necessary information and acts as a guarantee of the reliability of the data and the policy itself.

Checking MTPL by policy number

Checking on the RSA website can be carried out using various information:

- details indicated on the form;

- vehicle number;

- driver's license information.

To perform the check you should:

- Go to the official website - http://autoins.ru/ru/index.wbp.

- Next, go to the “Verify Authenticity” tab.

- You should click on the first line to obtain information about compulsory motor liability insurance and the date of the agreement.

- A form will be shown that you need to fill out with the document number and enter the security code.

After checking, the following may be shown:

- the form was not found, therefore the person is facing a fake;

- The insurer has an MTPL policy with the name of the company (the document exists, but it has not yet been issued)

- the policy is valid;

- the certificate has become invalid, which usually means the document is overdue.

Checking the MTPL policy for the car number

To check your MTPL policy by car number, use a similar procedure:

- Go to the RSA website and go to the “Information for road accident participants” section;

- The proposed form is filled out indicating the necessary information: vehicle VIN number, state sign, body and chassis number. The date on which the check will be carried out and the security code are indicated as auxiliary data.

Verification of OSAGO authenticity by car number

If everything is completed correctly and the policy is original, a check will be performed and the relevant data will be provided:

- details of the contract for compulsory motor liability insurance;

- the name of the insurance agency that issued the document;

- information about the driver or drivers who, according to the contract, can drive the car.

By driver's license code

To obtain information about your MTPL policy, you can use the details from your driver’s license. To determine insurance names you should:

- On the RSA website, go to the section titled “Data for insurance companies that are needed to find KBM.”

- Correctly enter driver information.

As a result of the procedure, the person receives a similar message as during previous checks. An auxiliary function of the service is to establish the bonus-malus coefficient.

Video

How to avoid becoming a victim of scammers

To avoid scammers you need to:

- do not sign contracts for compulsory motor liability insurance in places not intended for this purpose: street, car, cafe, apartment, etc.

- When signing the contract, be sure to ask for a license. The relevance and authenticity of the license is checked; there are online services for this.

- After drawing up the documents, it is necessary to check the correctness of all data. Otherwise, even a small mistake can lead to the invalidity of the policy and the inability to receive insurance compensation.

Source: https://osago-go.com/osago/kak-proverit-strahovoj-polis-na-podlinnost-po-nomeru-avto

Check the OSAGO policy for authenticity online using the RSA database

Cases where fraudsters deliberately forge MTPL policies and then present them as genuine documents have become noticeably more frequent recently.

Problems also often arise when purchasing insurance policies from small companies, whose licenses are subsequently taken away.

As a result, the insurance document turns out to be invalid, but its owner does not even know about it. All this is against the law.

To identify such problems, there is a special website that makes it possible to check the validity of a policy (both your own and someone else’s) directly online. This feature can be convenient if you are involved in an accident that was the fault of another party.

In this article we will look at exactly how you can check a policy, and also give a couple of recommendations on what to do with an invalid insurance document.

How to check the MTPL policy for its authenticity

Insurance experts advise checking the policy before purchasing it. This is done visually. Pay attention to the following important points that indicate the authenticity of the document being purchased:

- the form on which the policy is printed is larger than A4 size;

- it has watermarks of protection;

- there is a RSA logo;

- there are multi-colored fibers;

- there is a metal strip on the left;

- the policy number contains exactly 10 digits;

- for a printed document the EEE series was used, for an electronic document – XXX;

- all fields and forms are filled in, and empty cells are crossed out;

- the amount of the premium stated in the document corresponds to the cost of the insurance service you paid.

We also advise you to check whether the insurer is officially licensed. If it does not exist, he does not have the right to engage in insurance activities in matters of compulsory insurance. Please note that some insurers present their clients with suspended or revoked licenses, which are also invalid and do not authorize them to provide insurance services.

Checking the policy by policy number

Checking OSAGO for authenticity by series and policy number on the official website of RSA

The simplest and most reliable method of determining the authenticity of an MTPL policy is to use the domestic RSA website. To check the policy, you just need to go to the appropriate section. Next you need to enter:

- series of forms;

- form number;

- confirmation code.

If you entered the correct information, a new window appears on the screen, which displays information regarding the authenticity of your insurance document. All of them are contained in the RSA database. The status “Losed by the policyholder” is displayed on the screen. It is important that the validity period and name of the insurer written on the screen match the information specified in the policy you have.

If you check immediately after purchase, the status “Within the insurer” may appear on the screen. There is no need to worry, because the insurance company staff may simply not have time to enter the newly issued policy into the database. If the status has not changed for several days, you should contact the insurance company from which you purchased the policy.

The system may show the status “Lost” or “Out of Service”. In these cases, there is already cause for concern: perhaps the agreement for some reason has lost its validity. Clarify the situation with the insurer or contact the police.

The above method of verifying the authenticity of OSAGO can be considered reliable, but it does not guarantee one hundred percent protection against duplicates. Even if you have a duplicate in your hands, the database will still give the standard positive status of the document.

It is difficult to detect a fake, because fraudsters draw up such documents with absolutely identical validity periods. If you suspect you own a duplicate, just look at which car is covered. This can be done on the same RSA website at dkbm-web.autoins.

ru/dkbm-web-1.0/osagovehicle.htm.

After entering all the required data, you will receive the following information about the insured vehicle and the insurer itself:

- car registration plate;

- body number;

- contract status;

- the name of the insurance organization with which the contract under the MTPL policy was concluded.

All you have to do is check to what extent the information received corresponds to the real data specified in the compulsory motor liability insurance policy. If something does not match, the policy is a duplicate. In this case, you will have to contact your insurer or immediately write a statement about fraud to the insurance company.

How to check your policy online by car number

Situations arise in which it is urgent to find out the registration form number. Most often, this happens in case of loss of a policy, because in order to restore it, the insurance company must know the number of the lost document. The same may be necessary when participating in an emergency situation when the culprit does not want to immediately present his insurance policy.

Online verification of the authenticity of the MTPL policy by car number on the official website of RSA

In any of these situations, you can quickly check your insurance contract online. To do this, go to the RSA website using the link dkbm-web.autoins.ru/dkbm-web-1.0/policy.htm. The system will ask you to provide the following information:

- an identification number;

- register sign;

- body number;

- chassis number.

Remember that you do not have to fill in all the data, so you can fill out only one of the items. However, it happens that the system does not have enough information received, as a result of which it shows that the requested MTPL agreement is not listed in the database.

This may be an error, so it is better to enter all the requested data. Don't forget that the human factor sometimes works. The form, as well as the database, may contain the same errors regarding the technical characteristics of the vehicle.

This is not a big problem, but it is best resolved by contacting the insurance company.

Enter the date you are interested in in the request field. This allows you to understand whether the policy was valid for a specific period. This function often helps the party injured in an accident. In any other case, the current date is entered.

In the response to the request, you will see not only data about the vehicle and the insurance contract itself. A list of all persons included in the policy will also be displayed on the screen. You will see if restrictions apply to it. This will allow you to determine whether the driver was authorized to drive the vehicle.

Sometimes it happens that a particular person was allowed to drive within a certain period. In this case, a green response is displayed on the screen, and information about the specific admission date is also displayed.

Please keep in mind that it is impossible to find out the MTPL policy number from your driver’s license.

The function of checking a specific person can help in case of an accident. It also often turns out to be useful for monitoring the work of an insurance company. Perhaps you paid to add new persons to the policy, but the insurer forgot or deliberately did not update the information in the RSA database.

Due to such inattention and irresponsibility, problems often arise: for example, a traffic police officer may consider such a policy as an invalid document and even impose a fine.

If you decide to check your policy and suddenly notice an error, you should immediately contact your insurance company and request that the updated information be added to the database.

Conclusion

It is not at all difficult to check the MTPL policy for its authenticity. It is advisable to do this during and immediately after the purchase: this approach will allow you to avoid unnecessary conflicts with the insurer, as well as fines when checking the document by traffic police officers or the occurrence of an insured event.

If an error is recorded, feel free to contact the insurance company with which you took out the policy. Reliable and reputable insurers value the opinions of their clients and the reputation they have accumulated over the years, so they immediately resolve such controversial issues.

In the case of a small insurance company, the conflict may reach law enforcement agencies. If the insurer ignores all your statements, immediately contact the police.

As a rule, after such a decisive action, everything changes immediately: the employees correct the data or your legitimate money is returned to you. If not, deceived clients have to go to court, where the chances of them winning are high.

If justice is on your side, the cost of the policy will be returned in full. Additional compensation for any inconvenience incurred is also possible.

Source: https://OSAGOreg.ru/proverit-polis-osago-podlinnost-po-baze-rsa/

Database of MTPL insurance policies by last name and policy number

This issue is very relevant in the modern world, since due to the huge number of insurance companies, many drivers often fall into the web of scammers and buy fake insurance policies.

All this is due to the high cost of compulsory car insurance, both newly purchased and used.

Therefore, many motorists are looking for intermediaries to buy MTPL insurance at a low price. And it often turns out to be fake. In this article we will consider all the methods for determining their authenticity.

Methods for verifying the authenticity of an MTPL policy

- The most reliable method of determining authenticity is to contact the insurance company. Contact information about her is recorded on the form; if there is no data there, then the policy is one hundred percent fake.

- Using the Internet, you can check it on the official website of the Russian Auto Insurance Union.

It contains all the data on insured events, the names of insured clients, the number of accidents and payments for them.

- For each citizen who owns a vehicle, all insurances that he has paid for 10 years are recorded. In addition, data on all road accidents over the previous 24 months is included here.

Check by last name

- By last name in this database you can find the previous owner of the vehicle and find out how many times the insurance was paid. And find out what number is valid, if it is still valid.

- This method of checking a newly purchased policy is not possible. Since, in addition to the owner’s last name, it is mandatory to enter its series and number in the request line.

- If the series and number cannot be found out due to loss or damage, then this question must be addressed to the company that issued the policy or its agent.

Check by policy number

This must be done immediately after receiving it. Despite the fact that the insurance company seems respectable and reliable. Errors can be different - the surname is written down incorrectly, the document itself is drawn up incorrectly.

To check your insurance policy:

- You need to go to the official website of the Russian Union of Motor Insurers.

- On this site, you need to write “Check compulsory motor liability insurance policy by number” in the search bar.

- In the window that opens, we find the lines in which we enter the number and series, in the next line we enter the security confirmation code offered by the site.

- And click on the search button and wait for the result of the check.

Using this method, you can check both paper documents and those issued electronically:

- The insurer enters electronic documents into this database within a few days. And if, after the request, the search engine replied that the document is with the insurance agent, this is normal.

- It is worth sounding the alarm if the search query gives the answer “lost validity” or is lost. More details will be written below.

- Another option “printed by the manufacturer” means that no one has filled out this form yet and this policy has not been registered for anyone.

But this check cannot give a true guarantee that the document is valid; it is necessary to check the correspondence of the owner’s full name and the car.

Check by car number

If there is a need to check the availability of insurance for a specific car owner, but there is no information about his insurance and the owner’s full name.

Then you need to go:

- To the website of the Russian Union of Auto Insurers.

- Write a request - check your MTPL policy.

- Many verification options will open, select the option where you can check by car number.

- We enter the car number and find out the license plate number and series.

- Next, we check whether this document is valid.

- Here you can also check which of the car owners is officially allowed to drive.

Checking against the RSA database

The database of the Russian Union of Motor Insurers operates constantly on the Internet, here you can get any information on the MTPL insurance document. In addition, there is also a list of numbers where you can get advice completely free of charge.

In this database you can obtain the following information:

- Which organization issued this insurance document?

- Where is the policy currently, and at what stage of registration it is.

- Date and time of conclusion of the contract.

- The date and year from which this document came into force.

- Date, month, year when it will be invalid and whether you will need to pay for a new one.

In this RSA database you can get the following data:

- Completely all data about the car for which the MTPL policy is issued.

- Vehicle number registered in the state. registry

- Vehicle identification number.

- Condition according to the policy (valid, lost).

- Full contact details of the organization that issued this document.

Using your MTPL insurance policy you can find out:

- Its series and number.

- Name and contact details of the company that issued this document.

- Name and type of insurance.

Visual signs of the authenticity of the MTPL policy

All policies issued illegally are not paid for by insurance companies, and in the event of any accident, the owner of the vehicle will pay for the losses himself.

To prevent this from happening, the first thing you need to do when concluding an insurance contract is to visually inspect and double-check the issued document:

- You need to carefully examine the policy form; it is the same format as a sheet of A4 paper, but 11 mm longer.

- On the form, upon careful examination, you can notice greenish-blue shades throughout the form.

- The form must be held up to the light, it must have RSA watermarks on the sides, and an image of the car in the center.

- There is a metal strip on the back of the form. And on the front side of the form there is a QR code.

- The form itself is not white, but interspersed with red.

- You need to run your palm over the form - there will be no traces of the seal left on your hands.

- The policy number consists of 10 digits; when you run your palm over this number, you feel an unevenness in the shape of the numbers.

- All organizations working in this area use uniform forms.

- The part of the form that must be detached from the main document is purple.

How to choose a reliable insurer to take out a policy?

To avoid falling into the cunning networks of scammers, it is better to choose a well-known company that has been working in this field for a long time to insure your car.

The most famous organizations operating for many years in the insurance market are known throughout the country. Their details, address and phone number are easy to find via the Internet.

But if a company has been working in this field for a long time and is reliable from the point of view of lawyers, this does not mean that this company will have high insurance payments.

Therefore, we go online and look at the ratings of insurance companies. Having chosen a few more well-known ones, we look at the table of their payments (by motor vehicle insurance) and draw a conclusion - which company should you trust to insure your car.

What to do if you bought a fake OSAGO policy?

- The first thing you need to do is go to the police and write a statement to the auto insurer.

- Contact a reliable organization and conclude a car insurance agreement and obtain a compulsory motor liability insurance policy.

By purchasing a policy much cheaper than the established insurance amount, you can easily fall into the clutches of scammers. And the purchase of a fake MTPL policy is punishable by Russian law, Article 32 of the Criminal Code of the Russian Federation.

And do not forget that without knowing that the document is invalid, no one will make payments by submitting it to the insurance company; all costs will be paid by the car owner.

Based on all of the above, in order not to fall into the ranks of deceived citizens of car owners, you need to approach such a matter as concluding an insurance contract and obtaining a compulsory motor liability insurance policy with all responsibility and very seriously.

Although the price of this document is high, obtaining it will provide a high degree of protection for the life of the car owner and his car.

How to check the authenticity of a compulsory motor liability insurance policy by name? Link to main publication

Source: https://autopravilo.ru/avtostraxovanie/osago/kak-po-familii-proverit-podlinnost-polisa-osago.html

How to check an MTPL policy for authenticity in the RSA database online

Fake duplicate forms for compulsory motor third party liability insurance are actively passing around among motorists. Judicial practice shows that there are also forms in circulation that are listed as “lost”, stolen from brokers or insurers, and also issued by unscrupulous insurance companies after the license was revoked.

In order to avoid misunderstandings and conflicts arising from an accident, RSA (Russian Union of Auto Insurers) invites everyone to protect a possible unfavorable situation in advance and personally check the policy for authenticity.

To do this, you need to visit an online service with a complete database of compulsory car insurance, where you can find out the period of insurance activity and the name of the actual insured of any car (including someone else’s), both by series and policy number, and by vehicle registration numbers .

Visual principles continue to apply

Previously, experts advised to check the policy only by carefully looking at the document received in your hands:

- So that the size of the form is approximately 1 cm wider and longer than a sheet of A4 paper;

- The RSA logo was present in the security watermarks;

- Multi-colored microscopic villi are evenly distributed over the entire surface;

- A soldered metal strip was located along the left edge;

- The document number is composed of ten digital characters;

- EEE series – for policies obtained directly from insurers;

- Series XXX for electronic insurance;

- CCC series, used until 2015.

The requirements for accurate filling out stipulate that: all available information must be entered in the appropriate columns, and if any data is missing, the field must not be empty, but must be crossed out with a clear line.

The information on the form also includes the amount paid by the policyholder on the receipt as an insurance premium.

To avoid problems, the client was asked to make sure that the insurer had a license and that it had not been revoked or suspended.

OSAGO form old (left) and new (right) sample

Today, these principles have not lost their relevance, but they are not enough. Fraudsters skillfully use modern technologies, against which an unprotected person is powerless. That is why the RSA decided to combat shadow trends with the same measures, namely, the creation of a unified electronic database with free access for everyone.

Determine the status of a document by its series and number in the RSA database

It is convenient and easy to check your MTPL policy for authenticity on the RSA website. You go to the service and fill out the form:

- Select the appropriate series (EEE or XXX) from the options offered by the system.

- Enter the insurance contract number.

- Pass the site login security check by selecting the code from the picture provided.

Checking the MTPL policy on the RSA website by its series and number

In the window that opens, the system will provide you with the necessary information and insurance policy status:

- “Located by the insurer” - the resource will give this answer if the contract under compulsory motor liability insurance was concluded recently, and information about it has not yet been entered into the RSA database. The interested user needs to wait a while or immediately begin to clarify the position if the contract is not new, but it is not in the database...

- “No longer valid” or “Lost” - the contract is invalid and there is a reason to contact either the company to conclude another contract, or the law enforcement authorities to protect your interests.

- “Located by the policyholder.” Having received this status upon request, for reliability, compare whether the data on the terms of insurance and the name of the insurer that entered into the contract match. – If “Yes,” then the authentication check can be considered successful, but given the resourcefulness of the world of scammers, you cannot immediately recognize it as reliable, because there may be a “double” with identical details. That’s why RSA recommends taking another test, which will be discussed below.

What car is insured?

Check which car is insured under the MTPL policy on the RSA website

On the same resource, follow the link and enter the data in the form. After processing the received information, the system will display:

- Registration plate of the vehicle insured under this contract;

- Body number or VIN number;

- Active or inactive;

- The name of the insurance company that issued the document.

Having such information, the user checks the data with the existing documents for the vehicle and if they match, then there is no longer any reason to worry. If you discover any discrepancies in these data, you should submit a written request to the insurance company requesting an investigation into the cause of the discrepancy.

Only the car number is known

The online resource for car insurers has also provided the opportunity to check the policy, which is very valuable, especially in cases of a traffic accident when one of the parties cannot clearly provide either the contract number or the date of its conclusion.

Checking the MTPL policy by car number in the RSA database

Go to the RSA service, enter the data you have in the field of the proposed form in Russian characters.

For example, this can be only a registration plate or a set of information, including: vehicle identification number and registration plate, taking into account the region code, chassis and body number.

In the first case, checking the authenticity of the policy may be successful, but not always. Detailed information narrows the scope of the search, which is why an accurate result is obtained.

The date matters

When filling out the online policy verification form, it is important to indicate only the date that is significant for the resolution of your case. So, if you want to make sure that your contract with OSAGO is currently valid, then indicate the date of the current day.

And if you are resolving issues with a third party - a participant in an accident, then enter into the form the date when the unpleasant event occurred, requiring, for example, monetary compensation, because in such cases, the activity of the contract at that moment is important.

Other features of the RSA official website

There are cases when, in order to resolve a dispute or correct errors discovered during a policy check by a traffic police inspector, it is necessary to find out whether the contract under compulsory motor liability insurance includes restrictions or was it concluded without them? Such information is also important when a list of drivers allowed to drive a vehicle at a certain time is needed.

The request is included in the policy verification form, where the series and number of the driving license are entered. Let us remind you that a Russian driver's license is filled in with Russian letters. Where 4 alphanumeric characters represent the series, and 6 numeric characters represent the document number. If you have access, the system will confirm and respond to the request with a green field.

Note! Knowing only the series and number of a driver's license, it is not yet possible to determine the policy number in which it is included in the list of admitted persons.

Note to motorists

It is known that sometimes the reason for refusal to pay insurance compensation to both the injured party and the party at fault in an accident is the fact that, under the existing MTPL agreement, the wrong car is insured.

Let us note that, according to the Law on Compulsory Motor Liability Insurance, such actions by insurers are considered illegal even if there are duplicate policies, unless the company has evidence that the form was stolen.

Therefore, even persons with an invalid policy have a fairly convincing chance of recovering losses in court, where it will be established that the contract was concluded and payment for insurance services was made in full. This was reported in the recommendations of the Supreme Court of the Russian Federation.

How to act in such cases? Having received a refusal to pay insurance compensation, an independent technical examination should be carried out with impeccable adherence to the procedure for notifying the parties.

Then send a letter of claim to the insurance company, and then file a lawsuit against it.

To resolve the issue, you can involve a lawyer (the costs will still be paid by the guilty party), or act on your own.

In conclusion, let us remind you what to do if it was not possible to confirm the authenticity of the policy on the RSA website ?

In this case, you should submit an application to the insurance company requesting an internal investigation and attach a copy of your existing policy. Usually such a measure is sufficient, but some citizens have to seek justice by calling for the help of investigators from the competent authorities, who will have to establish why the concluded contract was invalid.

Source: https://osago-online-kalkulyator.ru/proverit-polis-osago-na-podlinnost-v-baze-rsa-onlajn/