How to buy a car from a dealer on credit

Who doesn’t dream of becoming the owner of their own vehicle, but not everyone can afford it, because car pleasure is not cheap. With the help of a loan, this becomes more realistic.

At the moment, there are many special loan lines and programs regarding car loans, which are provided both in banking institutions and directly from dealers.

But first, the citizen must decide on the make and model of the car, then contact the bank to agree on the terms of the loan, then find a store with a suitable offer.

And you can significantly shorten this path if you immediately go to a car dealership, and there you can choose both a car and a bank to receive a loan, since the dealerships have long maintained counters of partner banks for these purposes. In this article we will tell you how to take out a car on credit at a car dealership.

Feature of receiving

Car dealerships have a small number of partner banks

And this is quite logical! Typically, the salon cooperates with 3-10 banks, maximum. Well, where can you put all 1000 domestic credit institutions? Although modern technologies make it possible to send applications to everyone, in practice it doesn’t matter, each salon has few partner banks. Especially if it is a small dealer.

In this regard, my advice is to search for a bank in advance using the Internet, where there are currently favorable offers, then look for a salon with which it cooperates, and then check the availability of the car brand you need.

And when you successfully complete this puzzle, then maybe you will save money!

Most often, unfavorable lending conditions

Car dealerships themselves make good money from lead generation of their clients, that is, quite often banks pay extra to the dealerships for bringing them clients. And this, in turn, is all included in the full cost of the loan. Therefore, this loan program will be “cheaper” directly at the bank than at the dealer.

Look for a salon with “promotional” banks

Filter the market in advance - look not only for the seller, but also for the bank that currently has a good discount on the credit program, and then, which sales offices he works with.

This is a rather difficult task, since we still have few services on the Internet where we can timely track relevant information. Nevertheless, spend your time searching, because a car is not bought every day.

Know in advance what kind of borrower you are

Don’t think that because dealers have made such a convenient service (both the car and borrowed money in one place) that it is intended for everyone. If you yourself know that you are a “bad” borrower, that you are on the blacklist, then naturally nothing will be approved for you.

The same situation will happen if you have no credit history at all - for credit institutions you are just as bad as if you had one of unworthy quality.

Thus, find out the situation with your scoring rating in advance, order an extract for your CI, and so on, maybe you will find a lot of interesting things there for yourself that you shouldn’t go to a car dealership with.

Apply for a loan from your bank

If you actively use the services of one or another credit institution, keep a debit account there, or have a salary card from it, then first of all go to “your bank”.

Look at which salons he can cooperate with, take a look at his programs.

We guarantee that in most cases, as a salary client, a car loan will cost you much less than any other “promotion” from any bank.

Beware of "processing" by the seller

Don't think that salespeople are God's creatures. They never were and never will be, especially car salesmen. This is where the juice is for those who like big salaries. If you sell winter tires, that's an increase for you, and so on.

That is, of course, you must understand that a car is a product to which you can sell a huge amount of additional items. options, additional insurance, services, maintenance and so on. And when you are in a salon with borrowed money, and if you have been approved for a wide line of credit, then “from a generous shoulder,” you can gain a lot of unnecessary things.

And then you will pay for all this for more than one year, and from your hard-earned salary. Be careful, do not weaken your self-control!

How to apply

To apply for a car loan at a car dealership, you must:

|amp|

- Naturally, first decide on the brand of the car, it’s clear that you’ve already had it in mind for a long time (you’re not buying a loaf of bread)

- further, we would recommend filtering banks for better offers

- after which you look at which salons he cooperates with

- simultaneously track the availability of the car you need

- and when everything comes together, then you can collect a simple set of documents (more about it below)

- and go to your chosen dealer

- already on the spot, the citizen will be asked to fill out a form to receive a car loan (often, salon employees send applications to several banking organizations at once, so that the client has the opportunity to choose if the answer is positive

- the application is considered for a couple of hours, but there are cases when this process stretches for up to 3 days

- If there is a positive response from at least one of the banks, the client has the opportunity to sign a loan agreement

- at the same time, read more carefully the terms of the contract, whether a down payment is required, and so on

- At the same time, do not give in to the seller’s persuasion - he will probably distract you from something important

- if you have a down payment, then the loan terms will definitely be more profitable for you

- here in the salon, purchase CASCO (it is required), but the price for it completely depends on the specific insurance company (there are also a lot of “scams” in this matter)

- Don’t “subscribe” to buying unnecessary extras. options, life insurance and so on (it is illegal to impose this)

- Double-check the words of the seller, the conditions offered by the bank, and its actual conditions (at the same time, you can separately call the office of the credit institution and double-check everything)

- in practice, situations may arise that the car is not yet available, you still need to wait for it, and if you sign a loan agreement now, the debt will start ticking from that minute

ON THE TOPIC >> Conditions for car loans at Cetelem Bank in 2017

Required papers

Banking institutions treat clients who want to purchase a car from a car dealership on credit fairly, but they will still have to provide the necessary documents. Their list may differ slightly, but it depends on which bank is chosen.

If you provide a complete package, your chances of getting a loan will increase significantly. However, not everyone will be able to get a car loan at a dealership, since this requires meeting certain requirements, the set of which depends on the conditions of a particular financial institution.

If the bank considers the borrower unreliable or the source of his income is not constant, then a loan may be refused. In this case, it is necessary to involve a guarantor who can easily increase the chances of a positive response from the lender.

If an individual entrepreneur acts as a potential borrower or his guarantor, then you will have to prepare the following documents:

- if he is on a simplified taxation system - a certificate of registration of individual entrepreneurs and tax registration, a book of profits and expenses, a tax return, a receipt confirming payment of taxes for the last six months, information on cash flows or bank statements for the last 6 months

- on a standard taxation system - a certificate of registration of an individual entrepreneur and his tax registration, a receipt proving payment of all taxes, a cash book, a tax return in form 3-NDFL, and also (if bank accounts are opened) an account statement for six months

- on a single tax - copies of receipts confirming payment of taxes, tax returns for the last two quarters, account statements, cash book, invoices and a book of registration of strict reporting forms

Insurance

Insurance of a car purchased with a car loan at a car dealership is a mandatory condition of a loan agreement in almost every bank. Often, a banking organization independently selects an insurance agency for a client where they can obtain CASCO insurance. In some cases, he may provide the borrower with a list of organizations to choose from.

Car dealers usually try to impose on their clients the most expensive insurance, the cost of which can be up to 10% of the price of the vehicle. However, this is not the limit of the cost - the buyer must prepare for the fact that the most stringent insurance conditions will be imposed on him.

The bank and car dealership can force the client to buy not only a property insurance policy, but also insure his civil liability. This means that the insurance company will take upon itself to pay all penalties if a citizen causes harm to someone while driving. The cost of these services may vary and range from 500 to 2.5 thousand rubles.

Some financial institutions reduce the interest rate on the loan if the client agrees to insure his life. You must pay for this insurance policy annually, and to receive bonuses in the form of a reduced interest rate, you must purchase it for the entire credit period.

However, according to Article 16 of the Consumer Rights Protection Law, the client has the opportunity to refuse additional expensive services imposed on him. If CASCO was paid for a year in advance, then the client can refuse insurance and request the financial institution to return the corresponding amount of money.

More moments

If you just decide to come and buy a car on credit at a car dealership, then don’t rush, it’s not that simple. Even sellers have their own types of loans and many situations, which in turn affect the profitability of offers. What are we talking about? Let's look below at what we mean.

Captive banks

An organization acting on behalf of the official car manufacturer is a captive bank. At the moment, a number of similar structures already operate in Russia: Toyota Bank, Volkswagen, BMW and others.

In fact, this is a very good idea, both for businessmen themselves and for clients.

Since a car is an expensive product, few people take it for cash, therefore, in order to maintain sales at the proper level, it is imperative to either provide credit to customers or sell them the product in installments.

And if an auto concern opens a bank, it will no longer have to share profits with third-party lending institutions, as a result, the margin increases, and therefore it is possible to give discounts to customers or offer them more favorable conditions for auto loans.

ON THE TOPIC>> Review of car loan programs at VTB

What other benefits are there for the buyer:

- very favorable loan conditions, which are difficult for ordinary banks to compete with (the annual rate can be 5% lower than in other organizations)

- large selection of car models and trim levels

- fast loan disbursement (no more than 24 hours)

Flaws:

- availability of commission for opening and maintaining a current account

- large entry fee (up to 50%)

Express loan

Car dealership employees can offer their clients the opportunity to apply for an express loan. To do this, only 1-2 documents are enough, and registration will take several hours, however, you need to be prepared in advance for a high interest rate. This type of car loan is considered for 10-15 minutes, but the conditions will not be favorable in this case.

An express loan is a type of lending in which a citizen has the opportunity to take out a car on credit at a car dealership in just a couple of hours. However, this is where the advantages of such a proposal end.

And then there are a number of significant disadvantages:

- low maximum amount – up to 1 million rubles (with a regular loan up to 5 million)

- high entry fee - 20% of the cost of the vehicle

- high interest rate - will range from 17-20% per annum (with a regular car loan the rate will not be higher than 16%)

- mandatory registration of a CASCO insurance policy (without it, the interest rate may be even more than 20%)

If the buyer has the opportunity to choose for himself options for processing borrowed money, then it is better to choose the one for which he needs to provide the maximum number of documents:

- passport

- a second document confirming your identity (driver’s license, foreign passport, etc.)

- copy of work book

- income certificate for the last six months

- certificates of income of the guarantor or co-borrower

With this option, the monthly payment will be no more than 40% of the borrower’s income.

As practice shows, the more demands the bank puts forward, the more favorable the conditions are for the borrower. That is why it is better to spend more of your time rather than choose offers for which a loan is issued if you have 1-2 documents.

Interest-free loan

A zero-interest loan is a very interesting and tempting offer; in essence, it is an installment plan, but it has a number of features.

To apply for such an offer, you must make an initial payment, which will be at least 50% of the cost of the car, but the installment period will be short - a maximum of 2 years.

Monthly payments will be lower than with a regular type of loan, since most of the cost of the vehicle has already been paid by the client, but there is also a minus - most often you are not given the right to choose a debt repayment system (annuity or equal parts).

When drawing up a contract, you need to carefully review it to study the rights and obligations of the parties. Some banks provide sanctions, for example, changing the type of loan from interest-free to interest-bearing if the monthly payment is late.

No down payment

As you know, the cost of a car leaving the showroom immediately decreases by 10%. In the future, during the operation of the vehicle, as it wears out, its price will continue to fall by another 5-10% annually.

By requiring a down payment from the borrower, the bank tries to cover the difference in price created in case the client stops repaying the debt.

If a client is offered a car loan at a car dealership without a down payment, this means that the risks created will be mitigated in another way.

When providing such an offer, the bank:

- raises the annual interest rate by 5-10%

- reduces the maximum loan amount to 1-1.5 million rubles

- the car is registered as collateral

- CASCO insurance is mandatory (and these are additional costs)

- The borrower's credit history and solvency are carefully checked

In addition, other methods of leveling risks can be used, such as reducing the lending period from 5 years to 3, or the mandatory presence of a guarantor.

All this means only one thing - the client will pay more, and even service his debt on more severe terms.

Typical requirements for the borrower:

- having a Russian citizen passport

- permanent residence in the region where the car is purchased

- Availability of official work, minimum experience – 6 months

- income must be greater than the monthly payment by at least 1 minimum wage

- Age limit: 20-60 years for men, 20-55 for women

You can also get such a loan for a used vehicle if the mileage is no more than 5 years (for domestic cars) or 10 (for foreign cars).

In addition, not all banks issue car loans for the purchase of cars manufactured in Russia or China, however, for this there is a program of state support for borrowers from the Russian government, that is, part of the interest rate when purchasing domestic products will be subsidized from the budget.

Source: http://creditoshka.ru/pokupka-mashiny-v-kredit-v-avtosalone/

Is it worth buying a car on credit?

Mobility, comfortable and fast movement around the city, freedom of travel: the advantages of having a car are obvious to everyone.

Few people are ready to pay for a new car right away; several million or hundreds of thousands of rubles are a large sum for most Russians. In this case, people usually turn to banks.

Is it worth taking out a car loan? What problems can this cause for a car owner? How to get a loan with minimal risk for yourself?

When buying a car, you need to remember that there are no loans that are profitable for the buyer and that the most profitable thing is full payment upon purchase.

https://www.youtube.com/watch?v=NbHTXOASwbs

If you decide to take out a car loan, but don’t know how to do it profitably, consider a number of useful tips:

- Any car loan or consumer loan requires payment of interest to the bank.

- Compared to personal loans, auto loans have a lower interest rate. The difference between them is significant – 2 or more times. Below we will see this with examples.

- You need to understand that banks dictate conditions: they can unilaterally increase the rate and reclaim the collateral if obligations are violated. But there are many banks, and everyone’s conditions are different.

- All signed documents must be carefully read. If in doubt, it is best to seek advice from an independent lawyer. You need to read the fine print especially carefully.

- There is no need to rush and agree to the first offer: study the entire financial services market in your region.

The bank’s website will not tell you how much a car loan actually costs: to do this, you need to prepare a package of documents and apply in person.

The consultant will calculate the cost taking into account the rate that can be offered to you based on your income level, taking into account the amount, term, make and condition of the car.

Only then will you find out under what conditions you can take out a car loan, and how much you will have to overpay for the car.

Let’s take as an example the car loan programs of VTB24 Bank, there are many of them - “Driver”, State Program for Subsidizing Car Loans, “Freedom of Choice”, “AutoPrivilege”, “Car Loan with Remaining Payment”.

The programs, of course, are different, each has its own requirements and features, and the bank indicates its own criteria with the wording “From” such and such an amount or period, which is quite difficult to obtain in reality.

But at the same time, the minimum rate for a consumer loan is significantly higher than the minimum for any car loan and ranges from 15%. This is one of the banks with strict requirements for a package of documents and confirmation of income.

Let's look at another bank, for example, Raiffeisenbank. A couple of years ago, he had an extensive offer of car loans with the possibility of purchasing: foreign cars, domestic cars, new or used, from an unofficial dealer, with buyback, with refinancing.

Rates dropped to 5% for a car loan, while maintaining 12.9% for the most profitable consumer loan. Attractive! But now the bank has curtailed all car loans - all pages on this topic have been deleted on the official website.

It remains to be assumed that the risks for the bank in such conditions turned out to be greater than the potential benefits.

A bank with “soft” requirements will offer a higher rate than a bank with strict requirements for documents and proof of income.

For example, Vostochny Bank offers a car loan on the same day, with an amount of up to 1 million, without CASCO, for used cars, with a minimum package of documents. Let's look at the rate: 19%!

Answering the question whether it’s worth taking out a car loan in 2018, let’s say: it all depends on the bank . Please note that if previously almost every credit institution had such offers, now many have refused to provide these loans.

On the official website of Sberbank you will not see programs intended for purchasing a car.

Standard procedure for obtaining a car loan

For a car loan, banks usually require:

- Confirmation of citizenship and permanent registration in the Russian Federation.

- Documentary proof of income stability, provided that the monthly payment amount is approximately half of it. If there are guarantors and collateral, this figure decreases.

- Payment of the down payment (or they offer to take it upon themselves, but then the buyer’s debt obligations increase).

- Insurance (mainly CASCO) for the entire insurance period.

- Keeping a car as collateral until the debt is fully repaid.

- Make purchases only at those car dealerships that are in partnership with the bank. Leading banks usually cooperate only with official dealers, large showrooms and well-known brands.

First you need to apply for a loan and submit all the necessary documents.

The purchase itself occurs in stages. When it comes to a new car, there are usually 5 steps:

- Selecting a salon and car.

- Concluding purchase and sale agreements on credit terms and insurance.

- Applying for a loan and pledging a car as collateral.

- Payment to the salon account.

- Acceptance of the car according to the act.

When purchasing a car on the secondary market, the number of stages and participants increases . The bank will not approve the transaction and will not provide money if there are 2 individuals involved, so this operation is carried out through a salon or other organization. The intermediary, naturally, will demand his percentage.

Is it worth buying a car on credit from a car dealership?

Each salon offers to purchase a car on credit on the spot: a representative of a bank is always present there.

Such offers should be treated with great caution: usually the interest rates on such loans are several times higher than the rates on car loans from well-known banks. The only advantage is the speed of making a purchase - all actions are carried out in one day.

If you decide to agree, carefully study the documents offered for signature, pay special attention to the payment schedule, the amount of overpayment, insurance conditions, penalties for missing a payment.

Regarding insurance, we note that the law allows the car owner to choose an insurance company voluntarily . At the same time, both banks and salons usually insist on the insurance specified by them.

Don’t agree right away, first evaluate the conditions and compare them with those on the market. Perhaps the offer is worthwhile?

Additional marketing programs can be an advantage of purchasing at a car dealership . At their expense, you can get a discount even when purchasing on credit.

Many sell out collections towards the end of the year, many provide additional services (sharely free), cash backs, affiliate programs, etc.

It’s good if such conditions exist, but we need to evaluate them objectively. If the discount amount is 50 tr, and the amount of overpayment when lending in the salon is 250 tr, maybe it’s still worth contacting the bank?

Installment without paying interest is a truly advantageous offer . But first make sure it is transparent and keep in mind that:

- until final payments, the car remains the property of the salon if the installment plan is issued as an interest-free loan;

- at the slightest violation, the owner can take the car back;

- Usually there is a significant down payment - in the amount of 40-50%.

A comparative innovation is the buy-back purchasing system, which provides for a deferred repayment of the debt and the possibility of the car being bought back by the dealership.

This scheme usually involves a slightly confusing calculation system . Part of the amount is paid in equal monthly installments, and the other part is paid with a significant deferment or on other conditions.

In fact, the car is taken for temporary use, for which a monthly fee is paid, and after a set period the user can sell the car back and use the proceeds from the sale to cover the debt on the loan balance.

The option is not always transparent, but it may be of interest to those who like to change cars or need a vehicle for a certain period of time.

It should be understood that the car always runs the risk of being damaged in an accident, stolen, scratched, etc. But such goods cannot always be “returned”.

There is no need to return the car: if the owner likes it, he can keep it, repaying the debt under established conditions.

Buying a car on credit involves many risks and nuances. Therefore, if you have the opportunity to buy a car without a car loan, it is better to take advantage of it.

The main rule of a loan: do not take it if there is a risk of being left without income and falling into a debt trap!

When applying for a loan, it is better to choose a reliable bank, carefully study its terms and conditions and compare them with other offers. The same should be done when choosing an insurance company.

In most cases, a car loan is preferable to a consumer loan. All signed documents must be read carefully; in this matter, it is sometimes worth enlisting the support of professionals.

Interest-free loans and installment plans, as well as quickly applying for a loan in a salon, must be approached with great caution and not make rash purchases.

Video: Bank loan or car loan?

You will be interested in:

Source: http://pravo-auto.com/stoit-li-brat-mashinu-v-kredit/

Taking out a car on credit: how to do it correctly and list of documents

Who doesn't dream of owning a car? At the moment, it is very difficult to do without it, since the busy rhythm of life forces us to travel long distances every day, travel on several public transports, waste time, money and our own strength.

However, most Russians are not able to purchase a car with cash. Therefore, absolutely all banks and car dealerships provide the opportunity to take out a car on credit.

This option is used by almost every future car owner, because in this case there is no need to immediately part with a large sum: it is enough to make a certain monthly contribution, previously agreed upon by the bank.

Taking out a car loan secured by a car: what is needed for this

So, you've thought carefully about what kind of car you can afford to get without too much damage to your own pocket. If you are serious about becoming the happy owner of a new or used car, you don’t need to collect too many documents to apply for a loan. Everything is quite simple and can be done quickly.

What documents will you need to take out a car loan? Basic:

- passport of a citizen of the Russian Federation (with permanent registration)

- driver license

True, some banks also require a copy of the work book with a certificate of solvency in form 2-NDFL (it is taken from the employer. Keep in mind that the monthly loan payment should not be more than 40% of the amount of your official salary).

In some cases, the bank requires you to provide other types of documents, which is purely individual and depends on the specific bank and your personal data.

Are you planning to take out a car loan without a down payment? This service is in wide demand, since not all car enthusiasts have the opportunity or desire to make a one-time payment of 20% of the cost of the car. Banks provide similar services, but there are certain nuances that we will now look at.

Firstly, the interest rate on a car loan may be higher than with the first payment. Accordingly, you will have to overpay. Secondly, the bank will take a more thorough approach to getting to know you and your credit history in order to make sure that its risk is minimal.

This means you will spend an order of magnitude more time and effort.

Almost all banks offer the opportunity to take out a loan secured by a car.

This option is the most optimal for both parties: if you take out a car loan and violate the terms of the agreement, that is, you make late payments for a long time, the car becomes the property of the bank, and after its sale, all funds spent will return back to the lender’s cash desk. If everything goes well and your loan is repaid on time, the bank will not have the right to claim the car.

Do you want to take out a car loan? We offer you to use a unique service: send an application to 30 banks, approval within 24 hours!

How to get a car loan from a car dealership?

If you have decided on the desired brand of car, and intend to contact the car dealership directly to apply for a car loan, to save nerves and time, prepare for a conversation with representatives of various banks.

Better yet, leave a request in advance through the loan selection service.

In this case, the professionals will choose the optimal loan terms for you, and you will only have to decide on the option that you consider more preferable.

At the car dealership you will be offered to take out a loan to purchase a car of two types. So, you can take out a loan for a used car or give preference to a new car.

When you buy a used car, you can never be sure of its quality, because the driving style of the previous owner will remain a secret.

It should be borne in mind that used cars are much more affordable in price, and the interest rates on them are usually the most favorable. But be careful and careful: be sure to make sure that the vehicle is in good working order and in good condition.

Remember: the stingy pays twice. You should not contact dubious organizations and small car dealerships to take out a car on credit. This is fraught with unpleasant consequences: from pitfalls in the form of increased interest rates or hidden fees, to possible fraud on the part of creditors.

A car loan must be applied for in banks with a proven reputation and large, famous car dealerships (see the rating of car dealerships). Yes, a popular lender will charge high interest rates for their services, but this will guarantee your safety. You should not trust banks that are ready to give you money with one passport: most likely, bad intentions are hidden behind this.

It is also advisable to check the car by VIN code - additional security measures will never be superfluous.

What to do if you decide to take out a car loan

If you decide to take out a car on credit, take it seriously and responsibly.

Consider all the options offered and decide what is best for you: take out a loan secured by a vehicle title, apply for a loan secured by a car from a bank, or choose a loan for a car without proof of income.

The amount that the bank will give you depends on the impression you make on creditors and the numbers indicated in the documents provided. Make sure that the technical condition corresponds to the declared characteristics (if you are going to buy a used car).

Purchasing a first car is an important step for every person. Cars purchased with a car loan require careful attention and are subject to mandatory insurance. Some companies require full CASCO coverage, others allow you to make a choice at your own discretion.

In this case, the car is considered collateral, and if it breaks down or becomes unusable, the insurance company will compensate the creditor bank for the damage. After you have received a car loan, do not forget to decide on a payment schedule, and remember: now you need to allocate a certain amount every month to pay for the long-awaited purchase.

Source: http://cars-bazar.ru/avtourist/vzyat-mashinu-v-kredit-naibolee-vygodno

How to get a car loan from a car dealership?

So, that happy moment has come when you decided to purchase your new car from a showroom. Maybe this is your first car, or maybe you are an experienced driver and just want to update your car. The main thing is that you are looking forward to purchasing your new iron horse.

Buying a car on credit at a car dealership

When buying a car on credit, the question arises: “Where can I get a loan from a bank or a car dealership?” There is no definite answer to this question, it all depends on the specific case, but still in 70% of cases it will be more profitable for you to buy a car on credit through a car dealership. Why? Let's figure it out.

First of all, it should be mentioned that we will be considering a car loan, and not a consumer loan for buying a car.

A car loan will have more pros than cons, but a consumer loan in this case will be much more expensive and not more profitable.

A personal loan is worth considering if you are buying a used car or if you do not have any money for a down payment.

Where to start buying a car at a car dealership?

First, you need to understand for yourself whether you can service the cars you are going to buy. We also need to roughly determine the cost of the car we want to purchase.

Evaluate your capabilities soberly and do not look at very expensive cars. Many people want an expensive car right away and don’t understand why they need it.

At this stage, visit at least 10 different car dealerships, look at the cars and talk to the managers. You can also sign up for a test drive and drive a car that you like.

The main thing is not to get hung up on one car dealership. Managers, as a rule, try to hold you back and make sure that you don’t look at all the options, but buy from them right away. They can be understood - this is their job. Visit at least 10 different car dealerships, look at different cars and at this stage you can get acquainted with the prices.

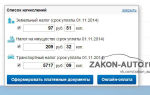

What is the approximate amount of a car loan you can expect?

Here is the loan amount you can count on. This is provided that you take out a loan for 5 years (60 months). If you are going to take out a loan for 3 years, then multiply by 36 months.

Now about the cost of the car. Do not forget that in addition to the loan amount, you will need to make a down payment, usually 10-15% of the cost of the car.

In addition, you will need to pay for insurance and possibly additional equipment.

You need to understand that even if you buy a car on credit at a car dealership, you will need personal funds to pay additional expenses.

We are looking for a car to buy on credit

Now that you have decided on the approximate cost of the car, you need to find the item itself to purchase. Start on the Internet - look at what car models are currently on sale at different dealers, read reviews of these cars, compare prices.

Call car dealerships, talk to managers about the characteristics of the car and find out all the details. Don’t get hung up on one manager and one salon - look at all the options. Each of the managers will attract you to their car dealership in different ways. The main thing is to soberly evaluate all the pros and cons of each proposal.

After you have completed all these steps, you can go to a specific car dealership and look at the car you are going to buy. First, look at all the cars that are in stock, and then consider options for ordering.

It may well be that if you have several dealers in your city for the brand of your future car, one may have the desired color and the required equipment in stock, while the other will only be available to order.

So study in detail all the options for car configurations of all car dealerships.

Conditions for a car loan at a car dealership

We have decided on the car itself and its cost, now it’s time to choose a car loan. And at this point we should touch on the topic: is it profitable to buy a loan at a car dealership? The answer to this question is clear - it’s profitable, but not always. Why? Let's figure it out

As a rule, several partner banks work with each car dealership. Representatives of some banks sometimes work right on the premises of car dealerships.

And the conditions are completely different. As a rule, one or more of these banks conduct some kind of joint promotion with a car dealership, or have a special loan program for certain types of cars. This is what we need to look for first!

First, find out everything from the car dealership manager, and then check all the promotions and programs on the website of the car dealership or bank. And only then you can go to the bank or to a banking consultant in the salon. Sometimes such interesting promotions are held that you can get an additional discount of several hundred thousand rubles when lending through a certain bank.

Another important point is the same as with car dealerships - don’t get hung up on one bank, find out the conditions of all banks and choose the best ones for yourself. The manager may take you to a specific consultant and say that the conditions here are the best. Do not believe him until you yourself become familiar with the conditions of all banks.

Bank conditions for a car loan may vary in the size of the down payment, interest rate, early repayment conditions, terms and additional insurance and other built-in purchases.

Remember a few rules:

- The lower the down payment, the higher the interest on the loan

- The longer the term, the higher the interest on the loan

- The more additional purchases, the higher the loan amount and overpayment

Minimum package of documents required to obtain a car loan:

- Passport

- Driver's license (or another second document, SNILS, foreign passport, etc.)

This is exactly what all sales managers at a car dealership and most bank consultants will tell you. Do not forget that their task is to sell you the car as quickly as possible.

Here are the documents that banks may require additionally, or you can collect them in advance and submit them for consideration of a car loan:

Documents confirming place of work and income:

- Copy of work record book (certified)

- Employment contract or copy

- Certificate 2-NDFL about income

- Tax return (if individual entrepreneur or LLC)

- Documents confirming your property:

- PTS or car registration certificate

- Certificate of registration of ownership (apartment, land plot, house, garage)

- And etc.

Banking programs are designed in such a way that if you confirm your personal data with some documents, then you are much more trusted. Accordingly, the likelihood of approval and the amount of the car loan will be much higher.

Pitfalls of car loans at car dealerships

What pitfalls can you expect when buying a car at a car dealership? Here, as in any other area of sales, there are sellers’ tricks and tricks, as well as many pitfalls that you can run into if you don’t know them.

The most important thing is additional purchases. In any dealership, and even more so when buying a car with help, they will try to sell you as much as possible. And what’s most interesting is that it’s easier for sellers to do this when you take out a car loan.

In order to sell you something extra for cash, you need to be persuaded to spend more of your money. And when people take out a loan, they don’t think about money at all and easily agree to make additional purchases. There is no need to spend your own money at the moment. No one thinks that by doing so you are increasing the amount of debt that you still need to repay.

There can be two directions for additional purchases and two people will sell them to you. The first is the sales manager of a car dealership.

He will try to sell you a more expensive car package, additional options in the car, additional equipment for the car, additional car dealership services for servicing the car, and more. Each salon has its own features and list of services and options.

The second “upselling attack” will be from a bank consultant. These guys are even more dangerous than the car dealership manager. The list of their additional services is growing larger and larger every year.

And the bank will increase the amount of your loan as much as possible through additional sales.

They have in their arsenal: all kinds of insurance for all occasions, additional road assistance cards, additional banking services (credit cards, accounts, etc.)

Also, in addition to additional sales, there may be risks when buying a car on credit through a car dealership. But there are no differences compared to a simple car loan from a bank.

The biggest risk is delivery of the car later than the contract deadline. There have been cases when a person took out a loan and ordered a car, but the car dealership did not deliver the car even at the start of the client’s first payment on the loan.

Such cases do not occur so often, but they still occur. If you have a choice of buying a car in stock or waiting some time for ordering, choose a car in stock.

Here is a small and general list of pitfalls; there can be much more. At all stages of the purchase, be very careful - ask a lot of questions and study all the documents you sign several times. Act as if everyone around you wants to deceive you, but without unnecessary paranoia.

Car loan at a car dealership without a down payment

It was previously mentioned that a car loan without a down payment is impossible. But there is still one option how to get around this. Let’s make a reservation once again that you can’t buy a car without money. There will still be minimal costs. For example, small costs for registration and insurance of compulsory motor liability insurance. But amounts of several tens or hundreds of thousands of rubles can be avoided.

Here, too, there may be two options. You can sell your car yourself on the secondary market and use the money for the down payment and all other costs. But besides this, the car dealership can enter into a Trade-in agreement with you and take your car as a credit for the down payment.

Many banks are willing to accept such transaction options. In this case, you will not need to bother with selling your car. But in this case you will lose a little money. The dealership will value your car below its market value. So the choice is yours - choose convenience and pay for it. Or spend your time and not lose money.

Finally

With this option, you can resolve all bureaucratic issues within the car dealership. Submit documents to apply for a car loan, complete purchase documents, arrange insurance, and apply for the car loan itself - all in one place.

And you don’t need to bother with money: when registering, the bank will transfer the required amount to the car dealership’s account “by bank transfer.” So this option has more pros than cons.

So if you don’t know how best to apply for a car loan through a bank or car dealership, the choice is obvious. Feel free to go to car dealerships, choose a car and drive away in the car of your dreams.

Good luck in purchasing a new car!

Video on the topic:

Source: http://agdedengi.ru/kak-vzyat-mashinu-v-kredit-v-avtosalone/.html