Check transport tax online

On the Auto Help Center website you can check and pay transport tax online.

The check is available both by a unique accrual identifier (UIN) for current accruals, and by TIN in case of tax arrears, i.e. for accruals that were not paid within the period established by law.

You can find out your TIN on the official website nalog.ru. To check and pay charges on our website, registration is not required.

Information on taxes comes from the State Information System on State and Municipal Payments (GIS GMP). Immediately after payment, the user receives confirmation in the form of a bank receipt to the specified email. All payments are made on the side of a certified system for making secure payments on the Internet, read more about the security of payments.

Why do the site display taxes that have already been paid?

At Autohelp.center, accruals are checked using the database of the official source - GIS GMP; this system deletes information about debts only after confirmation from the Federal Tax Service of Russia.

Confirmation may take 10–30 days, so accruals will be displayed in search results for some time.

However, it is important to know that by law the tax is considered paid immediately after payment is made.

Where to find a unique identifier (UIN)

The Federal Tax Service sends out by mail along with the tax notice and a receipt for payment. The unique identifier (UIN) is located at the top of the receipt and is called “Document Index”.

The document index is a sequence of 20 digits that begin with three digits indicating that the document is a tax document, namely 182. You can also find notifications in your personal account on the website nalog.ru.

To use your personal account, you need to register and receive a login and password. If vehicle owners have not received a tax notice a month before the tax payment deadline, the Federal Tax Service of Russia recommends contacting the inspectorate in person.

To check or pay transport tax by UIN on Autohelp.center, select the “SEARCH BY UIN” tab above and enter the document index numbers.

What is the difference between checking transport tax using INN and UIN?

Using the TIN for individuals, you can find out information on taxes only with an expired period, that is, on assessments that were not paid within the period established by law. By unique identifier (UIN) or document index for individuals. individuals can only learn about current accruals.

Do I need to pay taxes and penalties immediately?

You can pay the tax and penalties immediately. However, since tax payments are officially processed from 2 to 4 weeks, penalties will continue to accrue during this period (until confirmation by the Federal Tax Service of Russia). You will need to check your taxes again after some time and pay additional penalties.

What taxes can be checked on your website?

On the Autohelp.center website you can check the following types of taxes for individuals: 1. Transport tax. 2. Tax on property of individuals. 3. Land tax

Deadlines for payment of transport tax in 2018

For individuals, transport tax, land tax and property tax must be paid, in accordance with Article 363 of the Tax Code of the Russian Federation, no later than December 1 of the current year for the previous tax period. For example, tax for 2017 must be paid no later than December 1, 2018.

Tax amnesty 2018 for individuals

From January 1, 2018, tax debt as of January 1, 2015 will be removed from individuals and individual entrepreneurs.

At the end of December 2017, in a short time, the State Duma of the Russian Federation adopted a law on a tax amnesty for individuals on transport, land taxes and personal property taxes, as well as on penalties for corresponding arrears.

For individual entrepreneurs, tax debt on all taxes will be written off, except for excise taxes, customs duties and mineral extraction tax.

The initiative to hold a tax amnesty was made by Russian President Vladimir Putin, who, in his speech at a press conference on December 14, 2017, also focused on the need to exempt people from payments “in the most de-bureaucratic way possible.” That is, personal presence at the inspection office will not be required, documents will not have to be submitted - the tax authorities themselves will cover the debts and penalties for arrears.

Document:

Source: https://autohelp.center/nalog.php

How to check transport tax by car number?

After purchasing a vehicle, the car owner is obliged to promptly pay taxes for using the car for personal purposes. This is the responsibility of citizens of the Russian Federation.

But payment deadlines are often not met. How to find out transport tax by car number?

Transport tax is a mandatory duty for all individuals and legal entities . The amount is calculated depending on the brand, power of the car, region of the country, and additional characteristics.

For individuals, the fiscal service carries out calculations, and the contribution amounts are sent out by notification from November 1.

These funds are paid for the previous year. The amount must be paid within a month.

Afterwards, the car owner must additionally pay a fine, which will be charged for each overdue day. If the contribution amount is not paid in full, the car owner will automatically have a transport tax debt.

There are many different ways to check tax amounts by car number . It is important for a motorist to be able to check the tax on a car, since notifications about the need to pay often arrive late or do not arrive at all.

Let's look at how to find out the transport tax debt by car number.

Who pays the tax?

The tax is paid by persons who are owners of a registered vehicle.

If the car is the property of an individual, but the car was transferred by power of attorney to an outsider, the tax is paid by the person indicated in the power of attorney. Then the tax authorities must be notified of the changes.

A person is recognized as a payer if:

- the object is registered to this citizen;

- the vehicle is considered taxable.

Objects of taxation

These include cars, pneumatic and tracked devices, helicopters, airplanes, river and sea transport, and non-self-propelled vessels.

The following objects are not subject to taxation:

- rowing, motor boat (no more than 5 horsepower);

- passenger vehicles that can be transformed to suit the needs of the disabled owner;

- cars with a power of up to 100 horsepower purchased by the social protection service of citizens of the Russian Federation;

- fishing vessels;

- vehicles stolen by attackers during the investigation (if the situation is documented);

- transport of international importance, which is listed in the register of the Russian Federation;

- types of transport used by federal executive authorities, with the help of which military tasks are implemented;

- water and aircraft on the balance sheet of organizations, and so on.

Payment deadlines

There are clear deadlines for paying motor vehicle tax . They cannot be skipped, otherwise fines will be assessed.

Notification is sent 30 days in advance to the individual. If the letter does not arrive on time, you need to go to the authorized structures to receive a duplicate.

Typically, the deadline for tax payment by an individual is November 1, for a legal entity - until February of the next year..

Enterprises carry out calculations and prepare declarations. Advance contributions can be made once a quarter if reporting periods have been established in the area.

At the end of the year, the remaining amount of motor vehicle tax is transferred. Regional departments may adjust the deadlines. Information needs to be clarified with local authorities.

Since a car is a taxable vehicle, it is impossible to find out information on the debt using only the state number . Identification of the fee payer is required here.

You can find out the debt by directly contacting the Federal Tax Service . The organization will help the owner clarify the amount of payment for road tax, find out the debt by state number, and provide a receipt for repayment of the debt.

Personal identification required . Therefore, you need to take your passport with you.

But a personal visit to the tax office means long lines, bureaucratic delays, and a waste of time. How to check transport tax by car number online?

Online tax determination

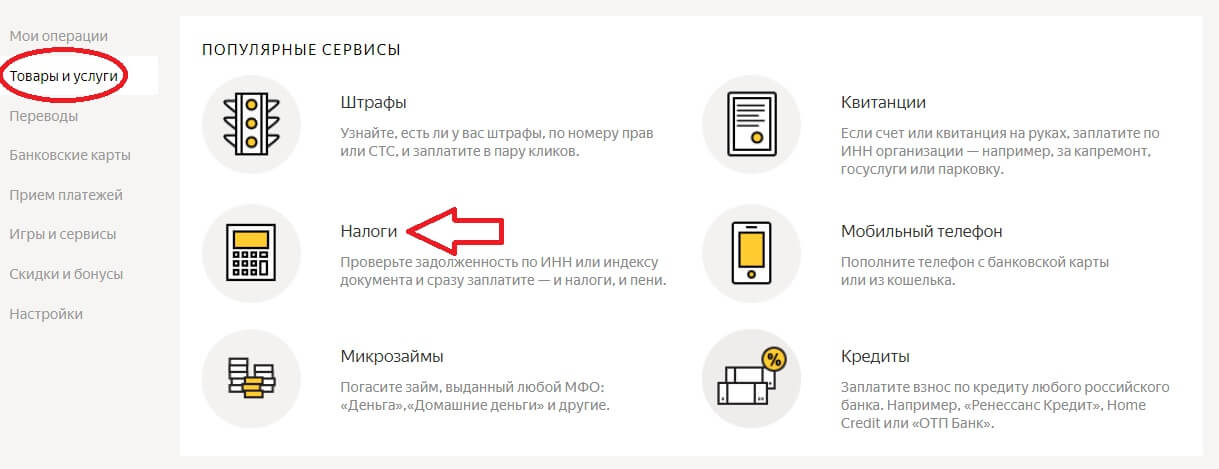

There are many different sites where you can check the tax by TIN. For example, the official website of the Federal Tax Service (https://www.nalog.ru/rn77/fl/).

The password and login for your personal account must be obtained from authorized structures. Tax accounting is carried out using an identification number .

It is assigned after the payer reaches the age of majority. This number (TIN) and last name are used to check the debt.

To obtain a password, first fill out an application stating a connection request. In the online application, indicate your full name, tax identification number, passport details, and registration. Print out in two copies .

The letter is addressed to the representative of the Inspectorate. After receiving the necessary data, log into your personal account on the website. The amount of the accrued amount can be found out three days after the first login to your personal account.

How to find out if transport tax has been paid by car number.

Public Services Portal

This service (https://www.gosuslugi.ru/structure/10000001169) provides users with access to tax document flow and other areas of confidential information.

The registration process takes longer . First you need to register, then confirm your identity. To confirm registration, you receive an activation code through service centers or by mail.

Network resources help reduce the time to identify debt to a minimum. A registered user can obtain all the necessary information in a few minutes.

An even more useful feature is the ability to instantly pay taxes on the same portals.

Other services

You can also request information on transport tax in 2018 from electronic devices equipped with Android, iPhone and other systems.

Applications can be easily downloaded from their respective stores and installed.

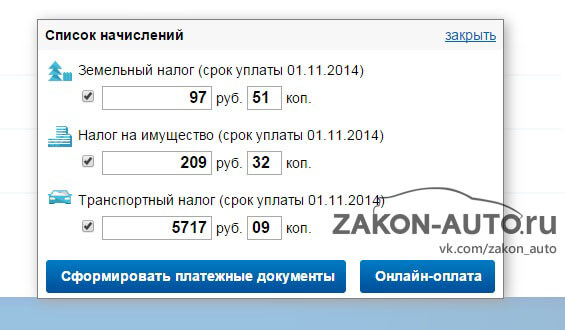

Sberbank clients (http://www.sberbank.ru/ru/person/dist_services) can visit their personal account, find out the amount of debt and pay it after entering the TIN.

The Yandex.Money portal (https://money.yandex.ru/new) is coordinated with Sberbank and also provides all the necessary information on transport tax.

You can also check the transport tax on the website of the Federal Bailiff Service (http://fssprus.ru/).

Recommendations for car owners

Some useful tips:

- After purchasing a used car, you need to ask the former owner about the amount of tax on the car.

- Find out whether the vehicle is listed in the Federal Tax Service database. If not, add the vehicle information yourself. If this is not done in a timely manner, additional fines will be assessed.

- You also cannot delay paying the fee. Payment must be made before November 1st.

It is advisable to register on the websites of government organizations using TIN and passport data. This way you can quickly and without queues find out all the necessary information.

You will be interested in:

Source: http://pravo-auto.com/kak-uznat-transportnyj-nalog-po-nomeru-avtomobilya/

Autocode - official website. Checking a car according to state standards. NUMBER or VIN code

On the Autocode website you can check your transport tax online. To do this, simply enter the vehicle’s license plate number into the verification form and receive a detailed report on the car’s history. The service is available to everyone without registration, and you can find out everything you need about the car in 5 minutes.

Tax information is located at the bottom of the reporting document. This section also contains information about the cost of compulsory motor liability insurance. The check is carried out according to the Federal Tax Service, the amounts are calculated for Moscow and the regions of the Russian Federation.

How to find out car tax

From the full report, you can not only find out the tax by car number and check the cost of the compulsory insurance policy. The reporting document includes another 15 sections, including a general certificate about the car and PTS data. Using the online service, you will find out information about the car’s age, country of origin, mileage, engine power, number of owners, and cases of accidents.

The system shows whether the car is listed as stolen, pledged or leased. If the car is used as a taxi and has traffic police restrictions, this is also indicated. A separate section is devoted to registration actions (displayed in a list indicating dates, region and status of owners). All facts are aggregated from the database of the State Traffic Inspectorate of Russia and other official sources.

https://www.youtube.com/watch?v=VLSrf55tz8Q

The report contains data on the current MTPL policy and completed technical inspections. At the very end, you can check information about unpaid fines.

Find out tax via Autocode

So what if you want to check your transport tax and find out the payment amount?

How to find out the amount of transport tax:

- open Autocode

- enter the state registration number (or VIN);

- we get access to the full version (don’t forget to enter the promotional code, it will be issued after purchasing the first report);

- scroll through the document to the section “Cost of OSAGO and tax”;

- Let's check.

If you don't know the vehicle's license plate number, use the VIN code. This is the vehicle identification number. The VIN contains 17 characters (Latin letters and Arabic numerals), which indicate the region and country of production, characteristics of the car, and features of the model year. A metal plate indicating the VIN is located on the body (less commonly, the chassis) of the car.

For Japanese cars that do not have a VIN, the check is launched using the body (chassis) or state number. number.

Advantages Autocode

Checking transport tax by VIN or state tax. number on the Autocode website takes just a few minutes and is available online around the clock without registration. The service has been operating steadily since 2012 and is recognized by ordinary motorists and organizations. In one day, the system performs more than 15 thousand checks, helping buyers and sellers of vehicles.

Checking information using Autocode is simple and convenient. You can use the mobile application by installing it on your smartphone. Be confident in the accuracy and reliability of the information you receive. And if an error occurs, payment is guaranteed to be returned to the user.

Check your car history now!

Source: https://avtocod.ru/proverka-transportnogo-naloga-onlayn

How to find out the transport tax debt by INN and car number, online through nalog ru, government services and other sites

Transport tax must be paid by all legal owners of vehicles, regardless of financial status, social rank, place of residence, as well as organizations and enterprises that have a car on their balance sheet.

All legal grounds are indicated in the Tax Code, and directly in the article on the payment of car tax - in Art. 28 NK part 2.

Vehicles for which this tax must be paid:

- cars;

- motorcycles;

- passenger buses;

- freight transport;

- snowmobiles;

- boats;

- helicopters;

- aircraft;

And other transport provided for in the article of the Tax Code of the Russian Federation.

What type of transport is not subject to tax:

- cars that are wanted, this fact must be officially confirmed;

- motor boats with an engine less than 5 horsepower;

- cars designed for the mobility of disabled people;

- cars up to 100 horsepower, transferred to the owner under a social program;

- agricultural machinery;

- air ambulance;

- fishing vessels;

- removed from state registration with the traffic police;

A complete list is available in the Tax Code of the Russian Federation.

How to check transport tax debt?

The tax office usually sends official notifications about the payment of this tax.

There are also times when this letter has not reached the owner. In this case, you just need to go to the tax office at your place of registration and find out all the information there.

Also, today in the age of Internet technology, all such data can be found online:

- on the Gosulugi website;

- on the website of the Tax Inspectorate;

- on the website of the Federal Bailiff Service;

In order to clarify information about overdue debts on these sites, you must enter your TIN in the appropriate line:

- Website "Gosuslugi.ru" - you need to go to the section "Informing the taxpayer (his representative) about the status of settlements for taxes, penalties and fines."

- The official website of the tax inspectorate - you must register in your personal account, go to the “Overpayment/Debt” section, or go to the “Find out your debt” service.

- The FSSP website today even makes it possible to constantly be aware of all legal proceedings; a special application can be installed on your phone or modern gadget.

- on the Nalog.ru website , log into your Personal Account, then select the point of payment for transport tax, and click the Cashless payment button. A list of financial organizations through which you can make payments appears.

You can select any bank, also, if you use a Qiwi wallet, then click on the appropriate button. Payment through this wallet occurs instantly. By the way, it’s quite easy to create this wallet; besides, if you make payments of more than 5,000 rubles, then this online payment system does not charge a commission.

There are still many options for paying this tax.

In fact, all such portals will require you to enter the TIN, since the tax is calculated and paid only on the tax identification number of the taxpayer, and not on the registration number of the car. Therefore, it will be difficult to find out your debt using the car number.

Payment period

The Federal Tax Service receives information about the new registration of ownership of a vehicle or its deregistration 10 days after registration.

This is the responsibility of those organizations that register the vehicle.

In addition, before February 1, annually, these authorities are required to provide all data on changes that are associated with the vehicle over the past year.

And the tax office must send a notification and a receipt for payment of this tax to the owner of the car. The vehicle owner must pay this receipt within 30 days.

However, not in all cities, especially large ones, the tax authority sends such official letters.

Then the owner’s responsibility is to independently clarify the amount of tax and pay it no later than November 1 of the current year.

How to calculate?

The transport tax is a regional tax and each region of the country independently sets the tax percentage. However, despite this, there are still rules and restrictions that local authorities are required to take into account when determining the percentage. These norms and rules are prescribed in the Tax Code.

In any case, car tax depends on the engine power of the car. Power is determined in horsepower.

Respectively:

- up to 100 hp – 2.5 rub. for 1 hp. WITH;

- up to 150 hp – 3.5 rub;

- up to 200 hp – 5 rubles;

- up to 250 – 7.5 rubles;

- over 250 – 15 rubles;

These are the all-Russian rates for payment of transport tax; therefore, the region cannot provide less than this. At the same time, each region can increase this rate up to 10 times, no more.

How to calculate your car tax yourself:

- Before calculating the amount of tax payment, you need to find a regional table of tax rates for transport.

- You need to know the engine power of your car.

- When the iron friend is released.

- In the regional tax rate table, find the column that matches your parameters.

- Multiply the indicated figure in the column by the number of horsepower of your car and by the number of months in the year.

For example:

- 160 hp x 3.5 x 12 months. = 6720 rubles per year.

How to pay?

Let's start with the fact that the receipt sent from the tax office can be paid at a branch of any bank or post office. Some banks will charge you an additional commission for transferring funds, while others will not. Also, if you have not received a tax payment receipt, you can print it from the website and also pay in cash.

You can also pay tax and tax debt by bank transfer through online banking. However, it is better to make such payment only through partner banks of the Federal Tax Service.

Very often, taxpayers use the Sberbank-online system.

To do this, just select a non-cash form of payment on the Federal Tax Service website in your “Personal Account”, a list of banking organizations will appear, select “Sberbank”, you will be immediately transferred to the bank’s website.

Next, you just need to select the account from which the payment will be made and confirm it. After completing the transaction, be sure to print the payment receipt and save it.

If you do not pay transport tax, then you may be charged fines and penalties, this is provided for in Art. 75 Tax Code. It states that for late payment of taxes or for evasion of payment, penalties for non-payment of tax are charged.

By the way, penalties will be accrued only after all possible deadlines for paying this tax have expired, that is, more than 3 months have passed since the deadline for payment. Also, the tax service may impose a fine of 20% of the debt amount, this is stated in Article 122 of the Tax Code of the Russian Federation.

How are penalties calculated?

All pennies are accrued for each day you are late without paying your tax.

The formula for calculating penalties is as follows:

- Amount of debt x number of overdue days x percentage of penalties x refinancing rate = amount of debt.

Also, the Federal Tax Service has the right to apply to the judicial authorities to demand payment of the debt, penalties and fines after 6 months after all possible deadlines for paying the tax.

https://www.youtube.com/watch?v=r9gaXz1jcc4

Find out more about how to calculate penalties at the refinancing rate.

Source: http://hardcorecase.ru/data/perevod/zadolzhennost-po-nalogu-na-transport.html

Find out your transport tax debt via the Internet

As soon as you have purchased a new car, it does not matter whether it is from a car dealership or purchased second-hand, you have a rough idea of what tax you will have to pay for it. But how to find out the exact amount of car tax?

In this article, we will tell you how to find out the amount of transport tax debt for an individual via the Internet using the receipt number, TIN and last name.

The main and most popular way to find out the amount of your transport tax is to wait until a receipt for payment appears in your mailbox. But we all know that any, even an impeccable system, sometimes fails, therefore, a letter can simply get lost at one of the post offices.

There are several ways out in this situation:

-

Contact the tax office with a request to issue a receipt for payment again;

-

Calculate the tax yourself, based on the tax rates in your region.

The last method is quite complicated, and should only be used if you are absolutely sure of the accuracy of your calculations and know the details for paying the tax. Otherwise, you risk sending the payment to the wrong place or transferring an incomplete amount of tax, which will lead to late payment penalties.

To make sure after payment that the payment has reached its intended destination, use the online check of transport tax debt. This service is available on our website, as well as on:

- The official website of the Federal Tax Service;

- State Services Portal;

- Website “Payment for State Services”;

- Website of the Federal Bailiff Service.

Please note: Before checking whether the tax payment has been made, wait a few days to allow the information in the databases to be updated.

We will describe in detail how to check transport tax debt using each of the resources below.

Search and payment of transport tax

The very first assistant in searching for transport tax is the official website of the Federal Tax Service. But in order to check the car tax online via the Internet using the tax website service.

ru, you still need to contact the tax office at your place of residence and create a login and password for your personal account.

As soon as you receive the password, be sure to log in to the site and change the temporary password to your permanent one.

We log into your personal account using your login and password, while the login is your TIN number, and you should have received the password from the tax office and changed it to another one.

Go to “Taxation Objects” and see what you have available. In the list you will see everything that you own, it could be a plot of land, an apartment, a house, a car, a boat, etc.

As you can see from our example, we have a car in stock. All data regarding the vehicle is indicated, so you can always check it in case of any controversial issues. There is also information about the tax service. By clicking on it, you will see information with the tax office address and reception time.

Next, select the “Accrued” button in the top line.

Since the tax period has already passed and all taxes have been paid, nothing has been accrued there at the moment. But in general, when the accruals are made, you will see a list of objects for which there are tax arrears. After reviewing them, you can pay for them immediately.

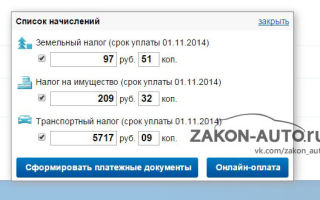

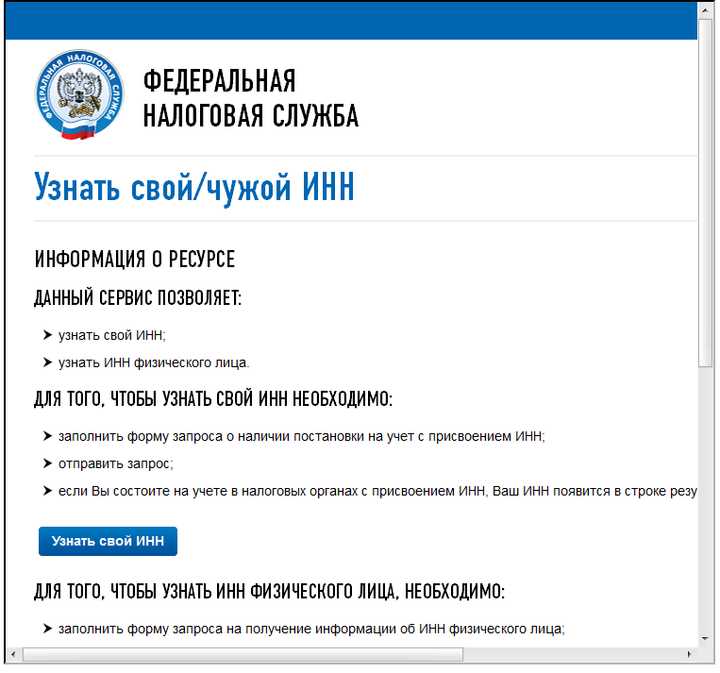

When you click on the “Pay” button, a window appears in which you can check or uncheck those taxes that you do not want to pay. In addition, you can change the deposited amount.

After that, select either “Generate payment documents” or “Online payment”. When you select the first one, a window will open with a receipt that you need to print. When choosing the second one, you need to arm yourself with a bank card and pay.

The unified portal of State Services is also of federal importance, so viewing the transport tax debt is an official (accurate) service.

In order to use this service, you must register on the portal website.

Important: registration takes up to 2 weeks, as you need to activate your account with a code that will be sent by registered mail. You can also activate your account in the “passport office”

For those who have already completed the registration process, we will provide detailed instructions on how to search for debt.

To get started, log in to the site to enter your personal account.

Click on the “Service Catalog” button at the top of the page.

Various services have appeared before us, but we need the one that is located in the “Taxes and Finance” block called “Tax debt”.

A detailed description of the service appeared on the screen. Once you have read it, click “Get Service”.

After you click “Get service”, at the same second a check begins using the TIN, which is already included in the personal information of your account. If you have not indicated your Taxpayer Identification Number, the verification cannot be performed.

In my case, no debt was found due to timely payment. But if there are charges, they will definitely be displayed, and you will be able to pay them in the future.

As can be seen from the above, checking car tax through the State Services Internet portal is not at all difficult; it is only important to have an account on a single portal.

Above, we offered you services for which you need to register. But you don't always need an account to check your auto tax.

Using the “Payment for State Services” service, you can check the presence of tax debts according to the Taxpayer Identification Number (TIN) or UIN without registration. How to do it:

We go to this site and select “Tax debt”.

The search is carried out both by the tax document index and by TIN. I choose the second one and enter the 12 digits of the individual identification number.

The search lasts only a few seconds, and after some time the transport tax debt appears on the screen.

This service helps not only to find out the car tax debt, but also to pay it, however, a commission will be charged upon payment.

Car owners who have several cars registered pay road tax for each of them. There are several ways to find out which car received the transport tax:

-

Wait for a letter from the tax office;

The tax notice, which usually arrives in the mail at the end of summer, indicates not only the full tax amount, but also its amount for each car registered to you. Which cars are subject to tax are indicated in the column “Object of taxation”

Please note: You can find out for what period the transport tax was calculated in the first column of the table – “Tax period”.

-

Check taxes on the official website of the Federal Tax Service.

When searching for tax charges on the nalog.ru website, information is also visible for each of the cars on which tax is charged. You can determine which car the tax was paid for by the make, license plate or VIN code - all this information is reflected on the website.

What other methods exist for checking tax debts:

– In the personal account of Sberbank, there is a point for paying taxes. You just need to enter your TIN information, and the debt will automatically appear on the page. You can pay it right away.

– Using electronic wallets. There is also a tax payment service available. Choose the required type of taxation, and you will see how much and where you owe.

We have listed all the possible ways to find transport tax debt. We hope that our article helped you understand the issue of how to check the payment of transport tax by an individual. Pay your taxes on time, and then you won’t have to worry about whether a penalty has appeared and whether the case has been transferred to the bailiffs.

Source: http://zakon-auto.ru/info/autonalog/zadolzhennost.php

Transport tax: how to find out the debt by car number?

All Russian citizens know that they must pay certain taxes and fees.

This also applies to transport tax - a payment levied in favor of the state for the right to use a car.

But in order to pay such a state fee on time, it is better to know the methods by which you can find out the transport tax debt by car number . This is exactly what will be discussed in detail in this article.

Payment of transport tax

Due to this payment, the state treasury is significantly replenished every year, since every year more and more citizens acquire their own personal means of transportation. In this regard, it is important for taxpayers to know how to check the transport tax by car number and when to pay it.

Transport tax is established by the Tax Code of the Russian Federation. This payment is a regional one, that is, the funds from its payment go to the budgets of the constituent entities of Russia.

Each region independently sets its own rate at which the tax is calculated. But it cannot exceed that established at the level of the entire country.

https://www.youtube.com/watch?v=qCvElNicKnc

You can consult the rate in a specific region at the Federal Tax Service inspection, at the place of registration of the citizen. Unlike organizations, individuals are not required to calculate the tax amount themselves.

Having received a payment notice from the tax office with a specific amount, the taxpayer must:

- check the transport tax debt by car number, recalculating it to avoid mistakes;

- choose the most convenient payment method;

- pay transport tax by car number.

As a general rule, citizens are given 1 month from the date of receipt of the notification to repay the tax. A longer period may be set in individual cases; this is indicated in advance in the notification from the Federal Tax Service. It is from the date of receipt of the “letter of happiness” from the inspection that the individual becomes obligated to make a tax payment for his vehicle.

The tax office's responsibility is to send the individual a notice no later than 30 days before the payment is due. Consequently, if for some reason the notification does not reach the citizen, his obligation to pay tax does not arise.

But, on the other hand, the law of a particular region sets a deadline for paying transport tax. Every car owner must bear this responsibility every year.

Despite the absence of a notification from the Federal Tax Service, the citizen will have a tax arrears. That is, debt, with subsequent accrual of penalties. That is why it is important to be able to track your transport tax debt by car number using several proven methods.

How to find out transport tax by car number?

Transport tax by car number, the driver can find out about the existing debt in the following ways:

- contact the Federal Tax Service at your place of registration. Of course, this will take some time, however, it is through this body that you can obtain reliable information about debts, since the Federal Tax Service cooperates quite closely with the traffic police and exchange information (including car numbers), with the help of which the car is identified;

- find out the amount of transport tax by car number online. This check of transport tax according to the state. number is much easier and takes less time. You just need to know which Internet resources you should go to to find out the information you are interested in;

- send a written request to the tax office via the Federal Postal Service . This method of finding out the transport tax by car number is the least effective, since while the letter goes to the inspection, and then the response to the request to the recipient, it is likely that the deadline for paying the tax will pass, and penalties will be charged.

To find out information via the Internet, one car number will not be enough. As a rule, your full name will also be required. the owner of the car and his TIN.

How to check online?

Today, there are at least 3 online resources where you can check transport tax by car number:

Now let's take a closer look at each of these online sources.

To receive information from the website of the Federal Tax Service of Russia, you must register by following the link. To obtain your personal login and password, you will have to contact your Federal Tax Service at the place of registration. As a result, the citizen should have a Personal Taxpayer Account, which contains all information on taxes.

What to do in your Personal Account?

- go to “Objects of Taxation”. All property owned by the taxpayer will appear in the list that appears. This list should also include a car for which you will need to pay transport tax;

- hover the cursor over the car data;

- information about the amount of tax, the date of its payment and the delay will be written opposite the column “Transport tax”.

As for the State Services portal, check the car tax according to the state. number through this site will not be difficult if the payer is already registered there and has an authorized personal account. If citizens are not registered on the State Services website, then first you will need the following:

- go through the standard registration procedure on the State Services website.

- confirm your identity. This can be done in several ways: personally come to the MFC, Russian Post office, or send a letter so that an identity confirmation code will be sent in response.

After completing all stages of the registration procedure, you need to log in with your details, select the “Public Services” section, and then “Tax Debt Check”. After reading the description, you will need to agree and click “Get service”.

Official website of State Services

Since the Portal user’s TIN was already entered when registering the account, the citizen will only have to wait for the results of the debt verification. He does not need to enter any more data. After checking, a window will appear indicating that either no debts were found, or the name of the tax and the amount that needs to be repaid will be displayed.

And finally, it’s worth touching on checking tax debts using the FSSP website. By going to this Internet resource, you can immediately find a line for entering your full name. the debtor of interest and the number of the region of his residence. In the event that enforcement proceedings have already been initiated regarding the tax debt, the right person will be found in the list that appears, based on the results of the request.

On each of the sites described, you can not only see the amount of tax, but also pay it without leaving your computer, choosing the most convenient method of non-cash payment. Or generate and print a payment slip and pay it at the bank office.

Online services

Many car owners are interested in the question of how to find out the transport tax by car number online. There is a clear answer to this question: no. Official Internet resources do not provide for searching for tax debts for transport by entering a car license plate number, since this information does not constitute any secret.

And, otherwise, anyone could look at information on someone else's car and the person who owns it.

That is why you can find transport tax by car number only by:

- TIN;

- FULL NAME. car owner;

- tax document index.

The car number is needed only at the stage of registering it with the traffic police, and then transferring it to the inspectorate for information.

If a citizen does not want to waste time registering on one of the sites presented, he can check the debt without registration on the “Payment for State Services” portal (https://oplatagosuslug.ru). To do this, you will need to follow the specified link, select in the “Pay” tab, and then select the “Tax debt” column.

To search, you must enter the debtor's TIN or tax document index. After a couple of seconds of waiting, a list of existing transport tax debts will appear. You can also make a payment here, but a fee will apply. There is no need to create your own account to check and pay on this Internet resource.

Dear readers, this article may be out of date, please use the free consultation form below.

From all that has been said, we can conclude that in order to check the debt on tax payments for a vehicle, you will basically have to enter the TIN and the driver’s last name.

Source: https://lawyer-road.ru/nalogi-i-sbory/transportnyj-nalog/zadolzhennost-po-nomeru-mashiny.html